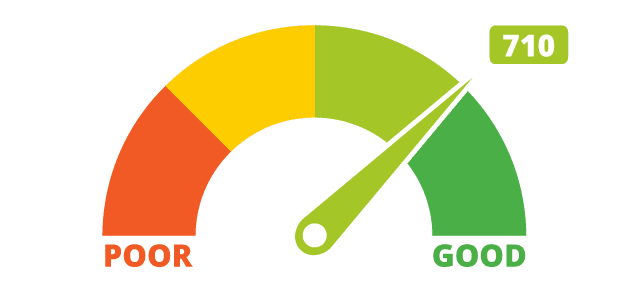

720 is an excellent credit score. Excellent credit scores are what everyone would like to have, but may not know how to go about achieving that goal.

The first thing that you must do to improve your credit score is pay all bills when they are due or earlier. Even being only a day late can lower your score. Even if you have made mistakes in the past and do not have an excellent score now, paying everything on time from now on can help to raise your score.

A variety of credit is much better than too much of one and none of another. For example eight credit cards is a lot, and should be reduced to a more reasonable number, like two or three. A couple of credit cards, a car loan and a house mortgage looks much better in your credit file than just having the credit cards.

Keep your credit card balances low. It is not a good idea to charge all your credit cards up to the limit. Try to keep them low so you always show available credit on your reports. Having them high will lower your credit score. If you want to purchase something on credit that may hurt your score, it’s a good idea to rethink it and decide if you really need it.

The length of your credit history is an important part of your score as well. It may take time to have your score go from good to excellent, but keep paying your bills on time, keep your revolving credit line balances low and eventually you will see your score go from very good to excellent.

Having an excellent credit score will help you in the future, you will get much better interest rates when you go for a mortgage, it will be easier to get car loans. Life is a lot easier with an excellent credit score. You will be glad that you put in the effort to makes you excellent.

I am not certain the place you’re getting your info, however great topic. I needs to spend some time learning much more or figuring out more. Thanks for great info I was looking for this information for my mission.