Your credit report may look like a tangled mess of account information, but it is actually an orderly and efficient way of presenting information. It may be too efficient, since most people have no idea how to read a credit report.

What compounds the problem is that credit reports all look different. Not only are there three main consumer credit bureaus, but depending on which credit report product you order, your report may look different than others.

That being said, you may want to consider where you obtain your credit report so that you can actually understand what you are reading. If you happen to know someone who works for a company that can pull one for you, it might be tempting to ask them to pull one for you. However, doing so is ill-advised, since those hard credit pulls can lower your credit scores. The reports that lenders pull are also the least consumer friendly reports, as they are intended only for professionals used to dealing with those reports.

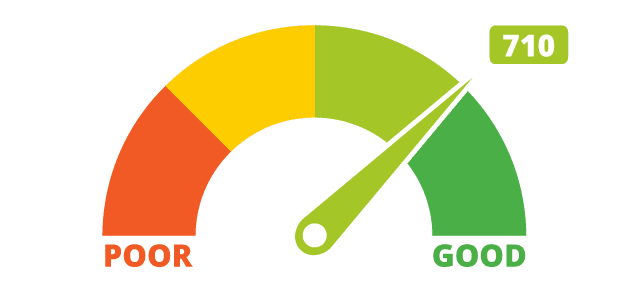

Instead, consider getting a consumer product that is meant for the average Joe. The reports available through the Annual Credit Report Service are reasonable enough and they are free. My particular favorite are the ones available through Fair Isaac Corporation. For me, it is worth it to pay a few bucks twice a year to obtain actual FICO credit scores based on the information held at each credit bureau. Additionally, the information is organized very well with simple analysis provided for the most important aspects of the reports.

It compares details from my credit reports to those of FICO High Achievers, those who are maximizing their scores based on characteristics of each category. It really is helpful to see how you compare to those with high scores so that you know what actions to take in the future.

There are some key items that you want to look for when reading your credit report. First, look for any negative information that you might want to contest. Negative information may show up as late payments, often reflecting a 30, 60, 90 etc that communicates a 30 day, 60 day or 90 day delinquency. Pay attention to charge-offs, since that can cause the debt to be listed again through a collection agency. Sometimes the collection agency record lists the referring creditor. Other times, you may need to compare the balances to match them up.

The date of last activity is important in terms of closed accounts. Most negative information drops off after 7 years. Positive accounts can remain for 10 years.

The information is organized in a cookie cutter approach, with information on each account listed in the same format. Harder to read credit reports show the order of information prior to the accounts listed, but there is no label within the account record. Therefore, you really have to focus to make sure you know what the amount in line 2 represents.

If you find that you are lost, consider contacting a credit counseling organization to request a credit report review. Most agencies charge less than $25, and many are able to provide the service for free.