Payment history on credit accounts is the single biggest factor that contributes to your credit scores. In fact, 35% of credit scoring inputs are based on your payment histories.

Payment history measures your on-time payments for consistency. Specifically what the credit bureaus are looking for is that your account status remains in “current” status for each account. As long as your account remains in that current status, it will continue to report as a positive account.

Closing a positive account will be reflected on your credit bureau. The positive payment history will remain on your credit report for ten years, providing a boost to your credit scores. Of course, that benefit will fade over the years until the account finally drops off your credit report.

Conversely, a missed payment will plague your credit report for seven years. Missing one payment can cause your scores to drop immediately, as it signals financial distress. That negative mark will continue to reflect negatively for the next seven years, although the significance will fade over time.

One missed payment, if corrected, does not ruin your credit the way that it used to. While your score will be lower, you are not penalized quite as severely. Fair Isaac, the maker of the FICO credit scoring formulas, made that change as a part of its FICO 08 changes that were implemented in 2009. Lenders that do not subscribe to FICO 08 base their decisions on older models that do penalize more for a single delinquency.

While a thirty day delinquency is relatively minor by itself, multiple delinquencies signal a more desperate financial situation that is reflected in your rapidly dropping credit score. The more severe a delinquency, the more your credit scores will suffer.

Credit accounts generally charge off as noncollectable bad debts once they are 180 days delinquent. Specific federal rules on credit card accounts require this treatment of accounts in default.

If you are dealing with delinquencies, the biggest action that you can take to improve your scores is to restore late accounts to a current status. This is the single greatest impact that you can make to improve your damaged credit.

How Long Do Missed Payments Affect Me?

Missed payments have lasting negative impacts for seven years. That being said, they tend to affect you less over time. Consider the way that a black eye may heal. It looks worse immediately after it occurs and is clearly visible for several days. It then begins to slowly fade. After a couple of weeks, it disappears completely.

Missed payments work the same way. Your scores will still be impacted by missed payments for a full seven years. However, that impact is less substantial as the date of the missed payments gets further in the past.

Once seven years have passed, the missed payment is deleted all-together. If the account was closed or charged off, then it will disappear entirely at that time. If you were able to bring the account current, then it will revert to a positive status once the missed payment drops off.

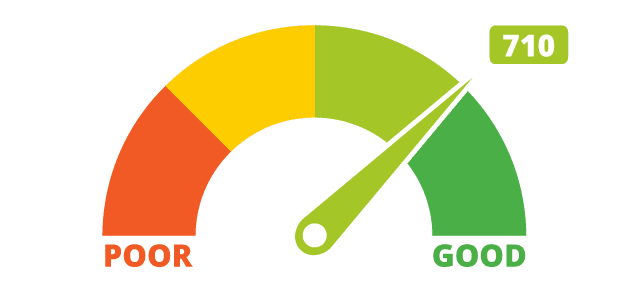

Payment history is the single biggest factor in determining your credit scores. Taking steps to prevent or correct damage can be crucial to maintaining or rebuilding your credit. If you need help in this process, you should consider speaking with an Accredited Financial Counselor who can discuss your options with you.