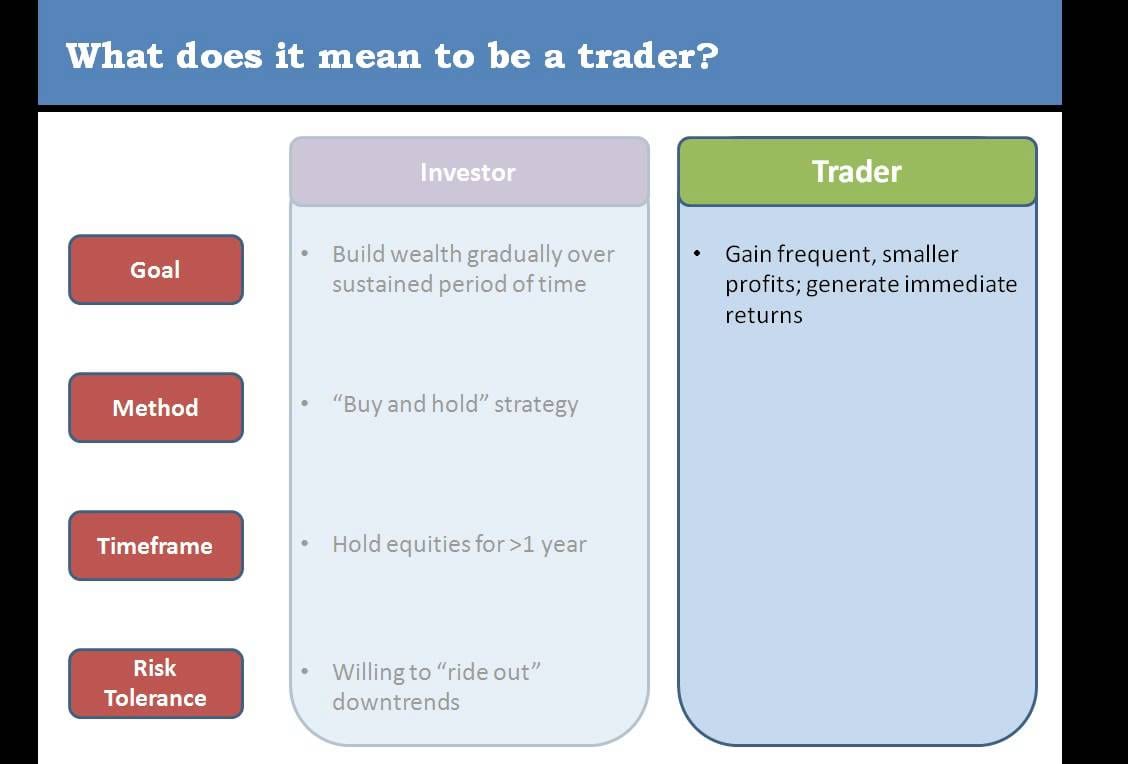

It is very important that you identify your stance in stock market. That is, are you going to invest OR trade in the stock market? If you are not sure about this, then you will commit a lot of mistakes and yield lower returns from your investments. You might be an investor and behave like a trader making losses and vice versa. I’m going to give a brief introduction to both of the types which will help you identify yourself.

Investors – Investors invest their money into stocks for a longer period of time. They invest into stocks with good fundamentals and stay invested till they reap profits, could it take a year or two or even more. A smart investor enters a good stock when it has corrected or say they buy good undervalued stocks and maximise their gains. They don’t put money into a stock that has already rallied up and are in it’s highs because a high valued stock has limited upside and they will not get much appreciation in that stock. So investors wait for a correction in the stock and buy stocks on dips. Investors don’t care about stop losses and targets, they invest from a long time view and only take out once they’ve claimed a nice appreciation. If the stock goes down a lot from their purchase price, they will continue to hold the stock or even buy more to average it out. They’ll hold it till the day the stock comes back to its highs and only then book profits.

Traders – Traders put their money into any stock that is going to give them some appreciation in a short term. They don’t keep money into stocks for a very long period of time. They identify a stock worth putting money into, then buy it keeping in mind a target price to book profits and a stop loss to book losses. Traders can never trade in any stock without a specific target and stop loss in mind. Traders exit the stock if a target or a stop loss price has been achieved in that specific stock. A trader does not care if the stock is undervalued or overvalued, all they care about is entering a stock that is going to give any appreciation in a day or a few days to a week. Since a trader maintains a stop loss close to the buying price, they don’t really have a chance to make much loss. Many times the already rallied stocks rally even further up and that is where traders make their profits and investors miss out. Traders sometimes also enter stocks with no fundamentals unlike investors.

A trader usually makes more profit than an investor but being a trader means putting a lot of time into stock market investing. Majority of the active traders spend their day trading in the stock market and that is how they mostly make their living. However investors are normally working people, a job or business who do not have a lot of time to give to stock market and so they invest into the market from a longer term perspective and don’t need to check their stocks all the time. An investor misses out returns during a time when he is waiting with cash on the side lines for the market to correct and market instead of correcting continues to make new highs, like the scene with current market. So if you have a lot of time in hand, it is better to trade than to invest to claim better returns.