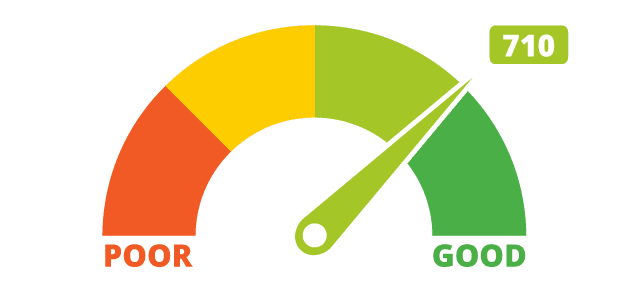

One’s credit score is a pretty good indicator of his or her financial health. Without a good credit score, a person will not be able to take out a loan or get a mortgage. It is also important to note that many employers check their prospective employees credit history before hiding. Fortunately, there are things that people can do if their credit is less than perfect. Below are a few ways to improve your credit score.

*Check your credit*

– There are many people who walk around with bad credit for years and do not know it until they are denied credit. Experts recommend checking one’s credit score at least once a year. People who have had a history of bad credit are advised to chick theirs more frequently.

*Reduce Debt*

– Most people are in debt these days. Some people are in debt for a good reason such as student loans and mortgages. Others are in debt because they made the careless decision of spending more than they can afford. Regardless of the reason, excessive debt can ruin a person’s credit. Paying of that debt can improve a person’s credit.

*Pay Bills on Time*

– One of the worst things that a person can do to his or her credit is fail to make bill payments on time. When a person does not pay bills on time, he or she gets negative credit reports. On the other hand, people who make payments on time will get positive credit reports, which can improve a person’s credit score.

A person who has a good credit score will have the greatest chance of getting approved for a loan. They may also have an easier time finding a good job. Checking one’s credit score once a year, reducing debt and paying bills on time are the keys to improving credit score. Financial advisors are a great resource for people who need additional help improving their credit score.

One thought on “Improving Credit Score Information”

Comments are closed.