Although the investing in the stock market has not been my primary choice for an investment vehicle, it is definitely seen as a reputable avenue for earning a decent ROI on your money. Admittedly, I know less about the stock market than I do about real estate, but, and let’s be honest here, the stock market is far less complicated unless you are day trading and studying charts and trending. So if you’re a stock market beginner, listen up.

At the moment I am very amped up on coffee so today I decided to talk about how to compare stock competitors in a sector by analyzing two coffee giants. Since this is a stock market for beginners blog, I will start simple. But before I get to the actual valuation, let’s visit a few of the common terms for the beginners investing for the time.

Before I get to the real meat and potatoes of stock valuation, it is important to understand why you would want to compare two stocks. The reason for comparison is rather simplistic. You want to know how a particular company compares to it’s direct competition. Competing companies and related companies belong to what is called a sector.

For example, two stores that compete to sell auto parts belong to the auto sector. But even a non competing company can belong to the same sector, like a company that rents cars to customers. A rental company does not sell auto parts, but is dependent on the auto sector to provide the produce what they sell. Make sense? In short, a sector is a part of the stock market that centers around a particular product. In the auto sector this would include auto parts, automobiles, auto repair, car rental, etc.

There are many sectors and for today, I will appropriately focus on the coffee sector. The two companies I am going to compare are Starbux (SBUX) and Peet’s Coffee (PEET). Both of these are obviously coffee sellers, but can also fit under larger sector umbrellas like food distribution. But the obvious smallest sector these two companies belong to is coffee.

The first thing I look for when examining potential stock purchases is a cyclic nature. If a stock has a repeating high price value, meaning it never goes above a certain price, and a repeating low price value, meaning it never goes below a certain price, then it is said to be range bound and/or cyclic. All this means is that you will see a pattern in the long term charts of a price that always stays between two values.

If a stock is cyclic then it is not a great long term purchase candidate as the price fluctuations will essentially cancel out any gain/loss you incur. If you are a good trader than a stock like this can be timed for large compounding gains. But that is closer to day trading or swing trading and out of the scope of this article.

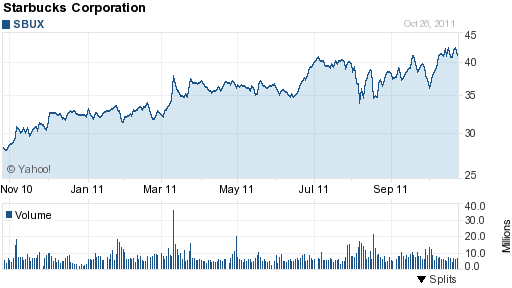

So let’s take a look at the real charts for SBUX and PEET. Assume for now that you actually want to invest in this sector because you believe a rebound will occur. Here are the charts for a year:

At first glance, peet’s appears to be doing better simply because it is not declining. But is it? To determine this we need to examine a few of the numbers. Starbuck’s EPS is .63, which means for every share the owner gets 63 cents of the earnings. With a share price of 15.53 this means that for every one dollar of earnings you will pay 15.53/.63 = 24.65 dollars. In other words, Starbucks has a 24.65 P/E multiple.

So how does PEET stand up to SBUX? Well PEET has a EPS of .72 and a price of 26.50. This tells us that the P/E is 26.5/.72 = 36.8 dollars for every one dollar of earnings. This makes Peet’s look significantly more expensive than Starbucks. But that would be assuming that each company has equal earnings.

So let’s take a look at the estimated future earnings of each company. Starbucks is estimated to grow earnings by 20% by the end of next year. With a P/E of 24.65 and a growth rate of 20, we know that purchasing SBUX at the current price will mean are paying 24.65/20 = 1.23 for next year’s earnings.

Peet’s earnings for next year are estimated to grow by 21.2%. So by purchasing PEET with an EPS of 36.8 and a growth rate of 21.2, this means we are looking at buying the growth in earnings for 36.8/21.2 = 1.736.

Using this P/E growth rate, called the PEG, we can see that Starbucks at 1.23 is a significantly lower price to pay than Peet’s 1.736. Assuming the market turns around and each company actually meets their estimates, then Starbucks would be a clearly better choice even though PEET is estimated to increase earnings more than SBUX.

In quick summary, the higher the earnings per share (EPS) the better. The lower the P/E ratio the better. And the lower the PEG the better. The latter being the most important as it shows how much you are paying for the stock’s earnings increase compared to that of it’s competitors. I hope this Stock Market for Beginners article will help lead you to your future wealth!