College is such an adjustment. Not only do you have the first year of college classes to plan for but you also have the adjustment of college dorm life, parties every night, roommate issues and so much more. You don’t want to fail but you will find it hard to succeed at times, if you aren’t prepared for everything.

One of the things that a college freshman must do, if they live away from home, is plan a budget to live on while attending school. Most college freshman never even think about this until they go away to school and suddenly they realize they can’t just run into the kitchen anymore and ask mom or dad for twenty bucks. This little fact will often come to mind when most college freshman hit broke for the first time.

In order to avoid the broke factor, you need to plan ahead for the rainy day that will have you feeling uneasy. You need to develop a budget.

If you are lucky enough to have your parents footing the bill for college and recognize the fact that your parents don’t want you working your way through college, you can discuss your college budget with your parents. What may come as a surprise to you will be the fact that your parents will pay for books, school and a meal ticket but no more than $20 or $40 will be sent to you for a week’s allowance. If this isn’t enough, and it probably won’t be, then you need to find a job.

A great place to work when you are in college, is on campus in one of the student-oriented jobs available on campus. You might want to work in the student book store or in the food court on campus or somewhere else on campus. The reasons these jobs work well for students, of course, is because of the fact the college will work around your class schedule.

Many college students will also get a job waiting tables. However, if you are going to do this then it would probably be a good idea to restrict your work schedule to weekends. You will also have to be careful not to get too involved with the mix of employees who often run around after work until all hours of the night and morning. Remember, keep your studies in focus and work only for a little extra spending money.

If you are lucky enough to have parents who will pay you an allowance, then you probably want to negotiate for so much every two weeks. Don’t be tempted to get this allowance for the entire month because in a weaker moment, you may find that you spend your entire budget in one day shopping or partying. Have your parents deposit the money into a front-load credit card or into your bank account every two weeks and learn how to budget the money they send you.

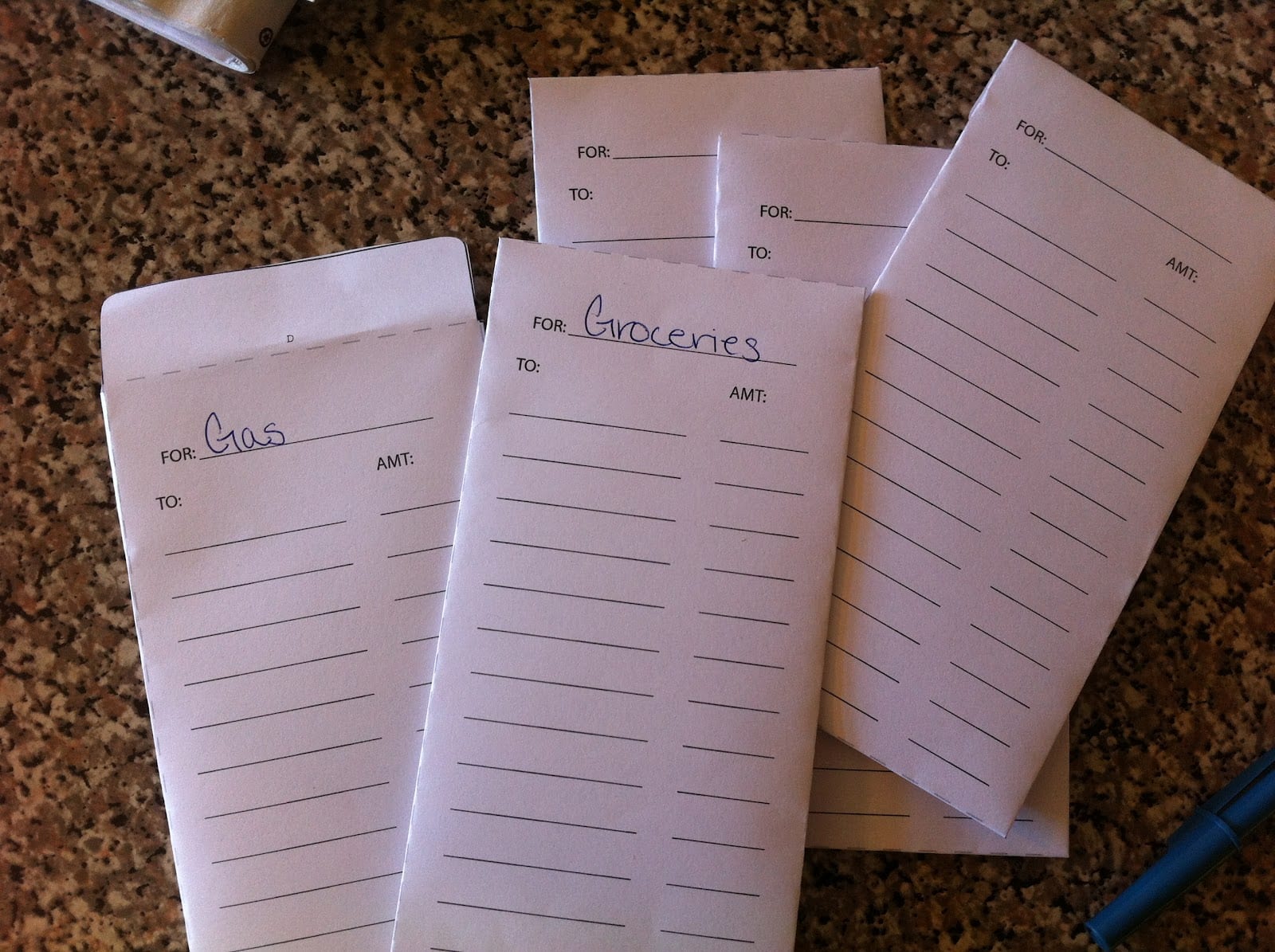

As a college student, plan to budget your allowance for school supplies, the occasional outing with friends, pizza night and other activities as well as gasoline and other necessities for your automobile. You will be surprised at how quickly you will need to learn to budget when you live on your own.

College students don’t plan for a quick need for a budget because they don’t think about it before heading off to school. However, before you know it, you will have the strong need for a budget and you will need to take care of your money. So take the time to set a budget you can live by while you are in college.