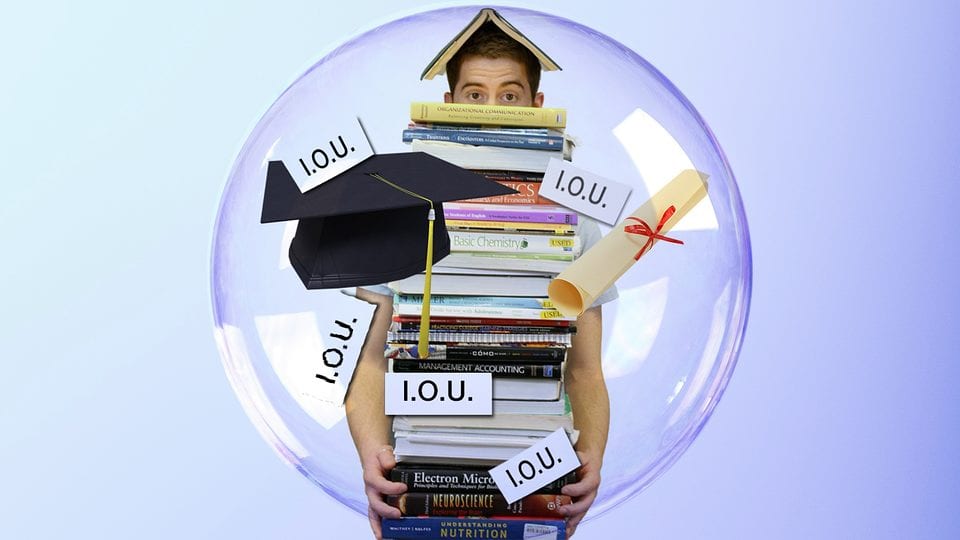

Student loan debt is on top of the mind for every student attending a university. College is usually an expensive endeavor due to the high cost of tuition, books, dorms, food and other extra fees. The issue with the high price is the fact that all students end up getting jumbo student loans to cover all the expenses. After getting away from university, the debt remains, and it is frequently challenging to repay totally. Thankfully, you’ll be able to reduce your school loan debts.

Scholarships and Grants:

Scholarships and grants ought to always be among the first actions to paying for your university expenses. As scholarships and grants are free money you can use for the degree, you won’t ever have to pay it back. Scholarships and grants can be found through the school, from private businesses and private organizations. They’ve unique needs, like a particular area of study or perhaps a specific GPA, but when you obtain the money, it reduces the amount of debt you are taking out.

Savings:

Open a university savings account early and set apart some money, especially for university. Beginning as soon as possible is perfect. Still, even though you start in high school, you could have sufficient money reserve to cover part of your university expenses without touching debts. A 529 saving account is an ideal chance to tear down your taxes and conserve extra money while investing that money. With the addition of some investing to the savings, you will end up getting more money for university accessible. If you choose to make use of a 529 university savings account, you will have to state it on your FAFSA application.

Work During University:

Working part-time as you go to university will help you handle expenses while you will go to college. While it may not supply sufficient money to cover everything, it can help you pay for some of the expenses like books and a part of tuition.

Limit Student Loan Debt:

Take out only the amount you require after exhausting all other sources of money to cover the school. This can reduce the amount of money you are taking out in loans by stopping you against taking out extra money. Maintain the number of student loans you are taking out to the lowest possible amount as opposed to the highest.

Consolidate Student Loan Debts – Top 5 Things That will Help

- Most people that enrol in higher education turn out to obtain college loans. Probably it’s time to consolidate school loans? A consolidation loan can help decrease your interest rate and incorporate your payments into only one or two payments.

- Why should you consolidate school loans? Lower interest rate. Your monthly payments will likely be under what you at the moment are. This you will save a lot of cash eventually.

- Federal School Loans must be combined on their own from private loans. You may be receiving a dramatically lower interest rate. Monthly payments could be diminished by around 53%. Finances will likely be made easier with only one particular federal payment each month. Payment will likely be distributed over a more extended period and monthly payments will probably be lower.

- Who’s Qualified to apply for a Federal Combination School Loan? In case you have more than $20,000 in federal loans, are certainly not in default, you’ll probably meet the requirements. Better still, you won’t need to get employed to consolidate; it is not necessary to have a co-signer and his like.

- If you’re going to consolidate school loans ( both federal and private ), contemplate consolidating your federal loans first. Obtaining significantly less wide-open lines of credit will improve your credit score and assist you in getting a better rate on private loans.

Make Loan Payments:

While you go to university, you are eligible to create loan payments on whatever student loans you have taken out. By paying as much as possible before getting away from university, when your degree is complete, you’ll have repaid an adequate amount of the loans to possess a smaller debt.

Conclusion:

Limiting your student loan debt is manageable. You need to steer clear of getting more than you will have to pay for university and employ other available options simultaneously.

Out of my observation, shopping for gadgets online can for sure be expensive, nevertheless there are some guidelines that you can use to acquire the best offers. There are continually ways to obtain discount offers that could help to make one to ge thet best electronic devices products at the smallest prices. Good blog post.