Retirement plans aside, not everybody is fortunate enough to begin investing in their twenties. Paying back credit card debt, establishing an emergency fund, and saving for home ownership all take priority over building a stock portfolio.

But if you can start investing, you certainly should. So how do you know when to start? Here is run-down of what the financial priorities in your twenties should look like.

Start with Retirement

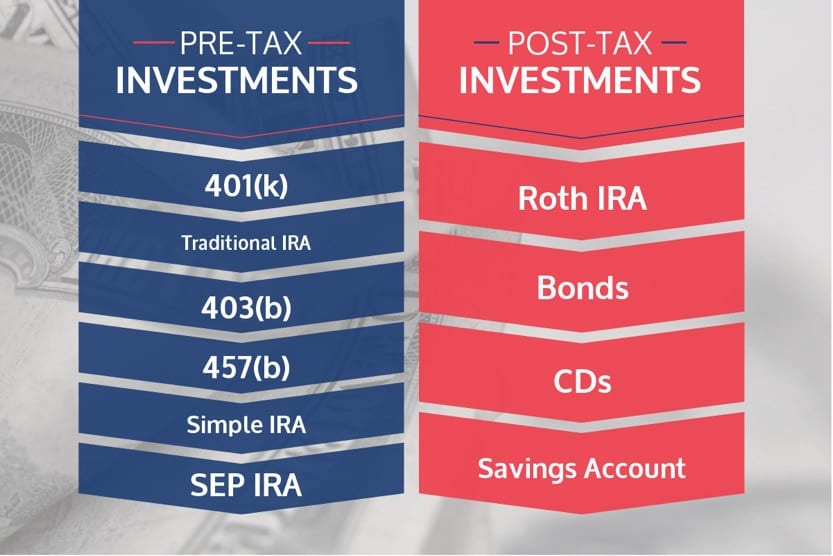

Even if you haven’t tackled all of your other financial priorities, think about saving for retirement right away either through your employer-sponsored retirement plan (401k / NPS / EPF) or an individual retirement account (IRA / PPF).

Even if it’s just $200 a year into an IRA, it’s important to get in the habit of setting aside part of your income for the distant future and you won’t have to pay federal income taxes on your contributions.

If you haven’t already, start saving for retirement now, and if you can, contribute the maximum up to IRA contribution limits.

Pay Off Credit Card Debt

Even in its best years, you won’t earn a return in the stock market that can surpass credit card interest rates. So tally up what you owe, take a deep breath, and knock out that ugly debt.

Get an Emergency Fund

Unlike cash in short-term savings accounts, investments aren’t always liquid, meaning you might not be able to use the assets you have invested in emergencies like if you lose your job or face medical expenses.

Once your debts are paid off, concentrate on building an emergency fund equal to at least three months of your income. In time you will want to grow this to about six months, but three months is a good start.

Keep Saving, Start Investing

Once you have an emergency fund established it’s time to start investing!

At first you won’t want to be quite as aggressive with how much you invest as you have been with paying off debt and saving.

Keep saving for upcoming expenses like your home, vacations, cars, even weddings.

Your investing priority should be retirement, and you’ll want to exhaust the ways you can save for retirement before turning to the general stock market.

If reach your retirement contribution maximums and are rearing to keep going, congratulations! Then it’s time to start considering buying some securities with an online brokerage.

What About Student Loans?

In most cases, it’s wise to start investing even if your student loans aren’t fully paid-off. Student loans generally have long terms but at fairly reasonable interest rates thanks to federal subsidies. With some aggressive investing you make more than you’re paying on student loans.