Your credit says a lot about you. It can dictate the type of home you own, the type of car that you drive, and the type of life you live. With data reporting agencies existing hand in hand with credit bureaus and companies around the globe all synching up data about you and how often you pay your bills, it’s important that you know what your credit report says and how to read it.

Identity theft, according to the FTC is the fastest growing crime worldwide. On a daily basis there are hundreds of thousands of reported instances of identity theft and a mounting number of fraudulent charges to banks, credit card companies, and even utility bills. With all of this risk to face, it is imperative that you protect your credit, and your identity from these malicious attackers. If the worst should occur itÕs also equally important to know how to fix your credit report and not be bombarded with empty promises on credit report repair tips from unethical companies.

There exists a multitude of different websites and literature dedicated to credit report repair tips and offering a variety of different suggestions on how to fix your credit report. Most of these websites will charge a fee either on a one-time basis or a membership fee to access their materials. The truth is, most of the best credit report repair tips are free, and can be found on credit agency websites, on credit card company websites and even at the FTC website.

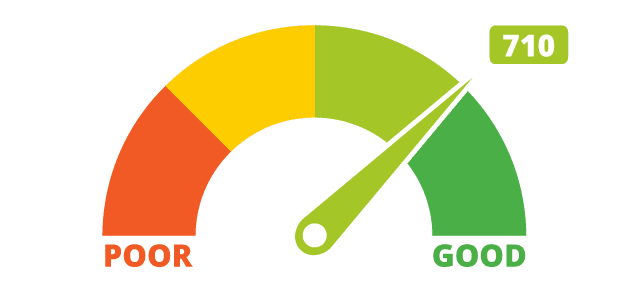

Ordering your credit report on a quarterly basis is the recommended solution to monitor the status of your credit, accounts, and ensure that inaccurate data doesn’t appear on your record. Oftentimes, the longer an item is allowed to remain on a credit report, the more difficult it becomes to have it removed, regardless of it’s validity. Most credit reporting agencies offer you an easy to read credit report, showing you the timeliness of your payments and the status of all accounts over the past 7 years. The majority of these can also provide you with your FICO score, and free tips on how to improve or raise it.

It has become significantly easier to obtain regular monitoring of your credit report through the “Big 3” agencies that handle collecting and reporting data. Many of the sites offer a subscription to automatically send your credit report to you every three months like clockwork. It takes a lot of the guesswork out of when and how often to review your credit report.

Credit report repair tips are quickly becoming a dime a dozen with the escalation of incidents of identity theft mounting, it’s proving extremely difficult to detect, prevent, and at times remove fraud. Credit repair can be costly and time consuming. The FTC reports, on average, it takes 100 hours per incident to achieve removal of negative items appearing on your report. Monitoring is the first step to reducing the time spent in disputes and knowing what your credit says about you.