There is hardly a week that the topic of investing in cryptocurrencies such as Bitcoin or others does not come up in a conversation. Sometimes because they go up meteorically and others because they go down. There are opinions for all tastes.

Personally, I believe that we cannot ignore crypto assets or Bitcoin as if they did not exist. It would be a kind of denial of reality. It is a new type of asset, but one that falls within alternative investments. And as such, it can have a place in a portfolio to de-correlate, but for other reasons as well.

Investing in cryptocurrencies for the long term. My point of view

In my opinion, I think anyone could consider investing in cryptocurrencies for the long term. Obviously, not as a core investment asset of a portfolio, but as a complement or satellite investment.

As we have seen these weeks and in other moments, cryptocurrencies are a very volatile asset. Do not suitable for all audiences. Or of course, not suitable for a significant amount of money within our heritage.

But you can invest in cryptocurrencies with little money. For a $100,000 portfolio let’s say 1-5%. Depending on the ability to take risks and personal circumstances, I think that is the range of capital that I would assign to an estate of that amount. Each particular case would have to be seen.

If it goes wrong. Nothing that the global investment strategy sinks you. And if it goes well. Certainly, an asset to add alpha to the portfolio in the long term.

How to invest in cryptocurrencies

You have to look for a reliable and safe intermediary. With many users. Where you can contrast opinions and references of other people who have invested through these platforms.

The key, as always, is to diversify. Cryptocurrencies are still an unregulated asset, which is still surrounded by a lot of uncertainty. And when I talk about diversifying, I don’t just mean investing in different digital currencies. I also think about investing in 2 or 3 different brokerage platforms. Which can be brokers or directly specialized cryptocurrency platforms. I give you some examples.

Coinbase is perhaps the best-known platform, for having made the leap to the markets and starting to trade on the Nasdaq. It is one of the largest platforms. The volume of digital currencies traded on this platform is skyrocketing. Some say that you can end up dying of success. And the experiences of some clients have not been very good lately, due to the great collapse of new account openings that they have suffered recently. For that reason, it is not strange to read some bad opinions.

EToro – If you are in Spain then an eToro ad is almost ubiquitous on YouTube video. They come on at all hours. This is a very popular platform for buying and selling stocks at zero cost, but also for trading cryptocurrencies. Personally, it is not the one I like the most. I prefer other more specialized ones.

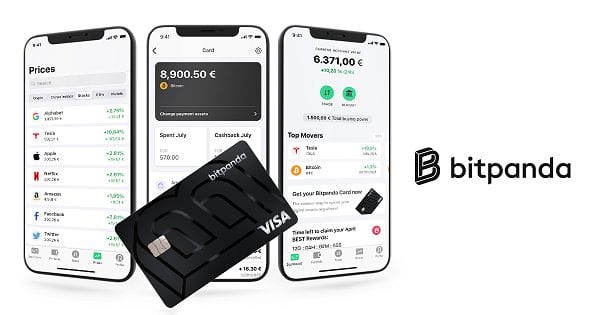

Bitpanda – those who know about these new alternative investments say that Bitpanda is one of the best platforms to invest in cryptocurrencies, due to its reliability and security. It is by the way also, one of the platforms in which you can invest in precious metals with physical support. Not just annotation.

Most cryptocurrency exchanges are preparing for the future leap to payments and have begun to offer cards with which to use digital currencies on a day-to-day basis.

And well, I could list many more cryptocurrency platforms or brokers such as Binance, Kraken, Bit2me, etc. There are quite a few wallets and exchanges. Here the key you have to look at is the differential between supply and demand that each applies. And then I would look at security a lot. Although that also depends on you as a user. But every time, news of robberies of digital currency warehouses is read. So be careful with passwords and security protocols.

Disadvantages of investing in cryptocurrencies

One of the worst things about any of the 6,000 digital currencies that you can invest in today is that you cannot calculate a fair value for it. Because they do not generate future flows. They are not backed by anything. They cannot be used (yet) in our day-to-day operations. It is simply the supply and demand that sets prices. That, and the tweets of an influential person. See Elon Musk.

This aspect makes cryptocurrencies a kind of long-term lottery ticket. Hence, yet another reason to diversify into different crypto assets.

It is not yet known how they will be regulated. If a digital currency has a virtue, it is that it is out of the control of central banks and traditional financial circuits. But that also makes them attractive as a hiding place for money from illicit activities.

It will end up being regulated, I’m sure. Regulatory development always lags behind innovation. At the time that money laundering control rules are put in place, it is regulated how to tax the profits in the sale of cryptocurrencies and the rest of legal varnishes, it will be one more asset, in which, probably, investment funds and others collective investment systems, can enter in a generalized way. And it will no longer be such an alternative market. Something that can happen in the next 3-5 years.

It is also unclear whether central banks will end up imposing their digital currencies ahead of Bitcoin, Ethereum and many others that have emerged from private initiatives. Some more serious than others. There is the risk, but also the opportunity. That is why I believe that investing in cryptocurrencies now that they have collapsed is a good time to sow for the future. The key: investing little money and diversification in every way.