With violent reversals current stock, the trader does not know whether to buy or sell and the investor is reluctant to build or to enter the market because the fall is probably not over.

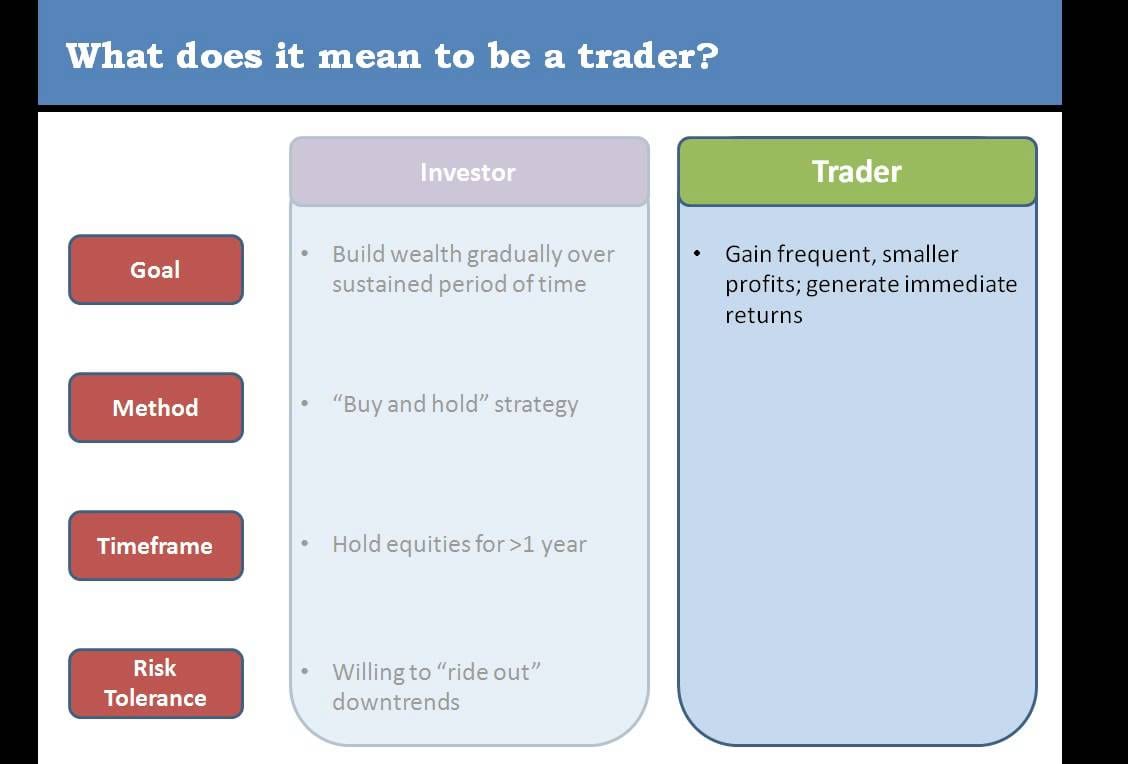

So if you are an investor and a little bit trader … there is something crazy. Do not worry, we will put the record straight. What to do, whatever your profile? The investor wants to grow its capital An investor seeking to profit from its capital over the long term, for example, a project financially.

The idea is to grow your capital over time, so that in X years, you are richer today. Success is measured in years by then. It is a complete philosophy of life, how to manage your money. And that’s what you have in mind right now: no matter how short-term markets.

The trader wants to be a little rich, but very quickly and very often. Conversely, a trader is someone who tries to beat the market in the short term and to deliver short-term income. This approach is obviously more risky – especially when you look at the markets in recent weeks, which gave us nice surprises and reversals.

The strategy here is to position themselves in securities that have met all conditions to see their classes quickly and strongly shifted (either up or down) in the coming sessions.

Is it time to buy? For long-term investors, the recent rout in the markets is the real godsend. This is the best time to buy shares for five months. Yes, the market may drop even lower in the short term it may come back to test the yearly lows or even crash down further! And right now, you find how the market? Quiet or risky?

It would be a shame to follow your gut right now, and you say “I will buy when it’s quieter. “Just remember the flight of investors during the fall of 2009: it was at this time that he was buying! copyright stock market today

Car buying quiet usually returns to first pass a strong rebound. The short-term traders should have a different approach. They must find a turning point on a title – or conversely when a course will accelerate.

But nothing is certain and everything happens very quickly. We must therefore carefully follow your trading scenario: playing an announcement of results, follow your technical goals. come from stock market today

And always place a stop. There is no urgency to buy a market in a low point: in trading, the opportunities are for all time. That said, there is no doubt that the current volatility offers great opportunities.

Do not just mix your long-term objectives with short-term strategy.