When the future is uncertain, as it always is on Wall Street, the best defense for mutual fund investors is a broadly diversified portfolio. But sometimes people confuse the idea of diversity with owning many different funds, and they wind up with a hodgepodge of investments that don’t perform in harmony with one another.

The key to protecting the wealth you’ve accumulated over the years is smart asset allocation — making sure your whole nest egg isn’t tied up in one basket. A well-conceived plan can make your portfolio more efficient and give you peace of mind, even when the market doesn’t go your way.

Think of the care we take in mapping out our career paths. We seek advanced degrees, we plot our moves up the chain of command and have a vision of where we want to go. But when it comes to investing, we often end up shooting from the hip, making decisions based on tips we see in magazines or on TV, or suggestions from co-workers and friends, says Richard A. Ferri, in his book “All About Asset Allocation.”

If this describes the way you’ve accumulated your assets, chances are your portfolio is not working as hard as it could.

Right now, stop everything, develop a plan. A long-term plan that will work for you for the rest of your life. This is about reaching financial security. And that doesn’t mean getting rich. The right asset mix can help you achieve financial security, not only for yourself but maybe for your heirs.

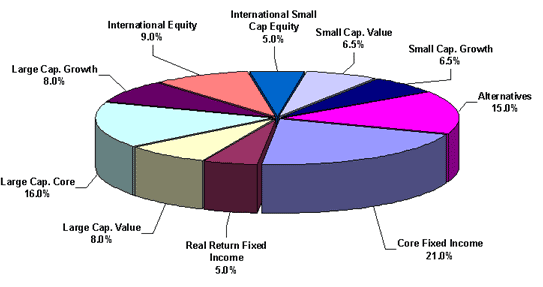

If you allocate your assets wisely, you’ll be exposed to all parts of the market, and won’t be left scrambling after the herd when one area gets hot. Your portfolio would already hold real estate, commodities and international stocks, at levels appropriate for your risk tolerance. When these areas do well, all you’d have to do is collect your profits when you rebalance.

In short, asset allocation is the second-most important decision investors make. The most important decision is to invest in the first place.

It’s easy to get distracted by the complexities of securities selection — deciding which stocks, bonds and mutual funds to buy. There are so many available, and no shortage of people eager to sell them to you. But it’s a mistake to buy the ingredients of your portfolio before you’ve figured out your recipe for investing success. And ultimately, knowing what you need, and why you need it, will make buying the actual securities that much easier.

Too many people … have a portfolio that has no rhyme or reason, and their asset allocation was basically determined by individual security selection instead of the other way around. You should make the decision to invest, you should decide what assets you’ll invest in, and then you decide what to buy. That’s the top down approach.

A number of factors will go into your asset allocation decision, including your age, income level, total wealth and your tolerance for risk, which is a very personal decision. Another issue to consider is liquidity; if you need ready access to your invested funds, you could wind up with lower returns.

When developing your plan, avoid the trap of looking at the segments of your portfolio in isolation. All the things that comprise your total net worth should be considered as part of an integrated whole, including your home, (which really is an investment in real estate) any defined contribution plan you participate in at work, and your future earnings power. You may be very comfortable investing in the industry you work in because you understand it so well, but you should be wary of compounding your exposure to risk.

The most basic asset allocation involves distributing your risk among stocks and bonds, but to have a truly diversified portfolio, you’ll need exposure to more asset classes than these two, such as real estate and other alternative investments loosely correlated to the rest of the market. More sophisticated investors can look for deeper diversity: Instead of just owning a world fund, you can invest in European securities, Pacific Rim stocks and emerging markets. Choosing low-cost exchange traded funds and index funds can help boost your total return.

If you need reassurance that the plan you’ve come up with is a good one, consider running your ideas by a trusted investment professional. Go to someone who works on a fee-only basis, rather than someone who works on commission, so you’re assured of an unbiased opinion.

The main thing is to gain enough confidence in your portfolio’s structure that you’re not second-guessing yourself in downturns. The market’s gyrations can test even the most diversified portfolio. But if you have a clear understanding of what you own and why, you’re less likely to make a performance-damaging leap when things get rough.

But don’t try to be a perfectionist. It’s impossible to develop an asset allocation that will work every time, in all conditions. Wall Street professionals have tried, and their efforts have proven that the perfect portfolio does not exist.

The problem with all investing is you’ll go through periods of time when what you’re doing isn’t working. But that doesn’t mean you shouldn’t do it. Come up with a good plan with all the data you can gather, implement it and maintain it, and just hang in there. That’s the solution.