The roots of asset allocation may be traced to the 1950s when a University of Chicago graduate student in economics was in search of a dissertation topic. The student, Harry Markowitz (we’re not making them up, folks), ran into a stockbroker (no injuries were reported) who suggested to Harry that he study the stock market.

Markowitz took that advice and developed the theory that became a foundation for financial economics. Harry later earned, along with William Sharpe and Merton Miller, the 1990 Nobel Prize in Economics, following work by the two of them that pioneered the Modern Portfolio Theory.

Today, Modern Portfolio Theory is called asset allocation. Read on to find out how this concept could help pad your portfolio, if not win you the Nobel Prize. Here are a few of the highlights of asset allocation:

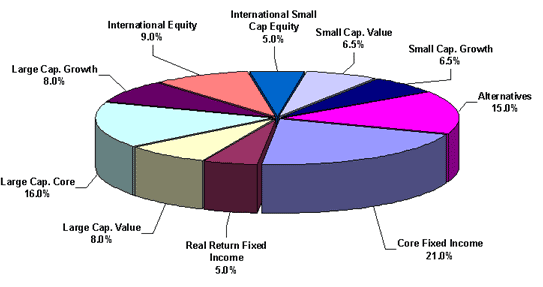

- Asset allocation is essentially the notion that you can minimize your overall investment risk and increase your potential for gain by spreading your investment dollars across various types of investments.

- Carefully consider what you hope to achieve through investing before you choose the make-up of your portfolio.

- Are you a thrill seeker, or a nervous Ned or Nancy? Gauge your emotional tolerances for risk before you invest.

- As you shop for investments, consider how an investment is classified, its performance history and what the experts are predicting about its performance.

- Things in life constantly change. Keep on top of your portfolio’s contents — and shake things up once in a while.