An exchange-traded fund (ETF) is a security that tracks a particular index or basket of assets. This could be the FTSE 100 or a selection of shares of companies involved in alternative energy.

ETFs are traded on the stock market, just like ordinary shares. So they can be bought and sold whenever the market is open, at a regularly updated price. By contrast, passive unit trusts – a rival tracking product – can only be dealt with once a day and only through the issuing manager.

Even though ETFs trade like ordinary shares, they don’t attract stamp duty when they’re purchased.

Diversification and cost benefits

ETFs offer exposure to an entire index, usually at relatively low cost. They are not actively managed, which means there is no need to pay fat salaries to a fund manager. As a result, annual expenses paid by the ETF investor are relatively low, typically between 0.2 and 0.75 percent of funds invested.

What’s more, ETFs are not subject to an initial charge or set-up fee, as is the case with unit trusts. The only costs when dealing are the standard brokerage commission and the spread – the difference between the prices at which you can buy and sell.

What’s on offer?

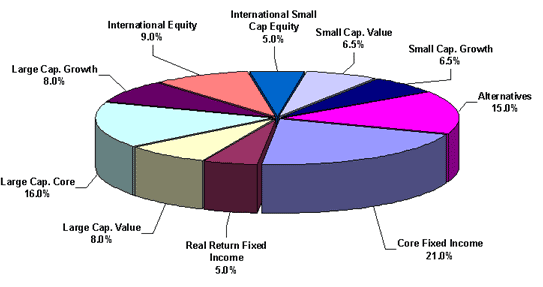

Today, the range of ETFs on offer is wider than ever before, covering an ever-expanding array of national indices, industrial sectors, commodities, futures, bonds, and other asset classes.

Consequently, it is now much easier for private investors to gain exposure to a range of previously inaccessible markets. There are also opportunities to achieve double or treble returns, as well as to sell short.

Index and specialist ETFs

Besides mainstream ETFs that track the world’s top indices such as the FTSE 100 or the Dow Jones, you can also buy or short sell individual industries such as mining or financial services. So, if you were bullish on the stock market in general but bearish about miners, you could buy an index ETF while short selling a mining ETF.

As well as national stock markets such as China or Brazil, ETFs cover segments of the market, such as mid-sized or small companies, and also entire geographic regions such as Europe or Asia.

Away from equities, there are ETFs that track commodity indices, government and company debt, real estate, private equity, and currencies.

Profit when markets fall

Whereas unit trusts generally only benefit when the markets they track go up, there is a type of ETF that gains in value when their underlying market falls. Short ETFs provide a mirror image of whatever the price of the underlying asset does. So if oil falls, they rise.

However, in terms of the equity-linked indexes, these types of ETFs are only really suitable for sophisticated traders. This is because the price of the benchmark index is re-set daily, and the returns are compounded – so, even if the index is down over an extended period, an investor who held on through volatile trading conditions could still conceivably lose money even if he was right in his prediction of a fall in the underlying.

Exchange-traded commodities

Originally, the large size of commodity futures contracts prevented small investors from getting direct exposure to commodities. With the advent of exchange-traded commodities (ETCs), the minimum financial outlay has been markedly reduced, thereby easing the way for private investors.

ETCs track the performance of individual commodities such as copper, petroleum or wheat, or even total return indices based on a single commodity. For example, many investors have recently gained exposure to physical gold for the first time through the use of ETCs such as ETFS Physical Gold (code: PHAU), which has been designed to provide a return equivalent to movements in the gold spot price. Currently, around 70 percent of private investment is allocated to precious metals, while 15 percent is given over to energy ETCs.

If, however, you want to spread your risk, you could always opt for an ETF that invests in a more diversified basket of commodities, such as the ETFs All Commodities ETF (AIGC). This has been structured to track the DJ-AIG Commodity index.

Government and corporate bonds

ETFs have also made it much easier for private investors seeking to buy into the government and corporate bond market. As ETFs are traded on the stock exchange, both historic and real-time pricing must be made readily available. Such price transparency was once the preserve of institutional investors, so ETFs have done much to open up this market.

As most bonds are held till maturity, the main problem facing those structuring a bond ETF is ensuring that it is comprised of enough liquid bonds to track a particular index. (This is more of a problem for corporate as opposed to government bonds). For this reason, representative sampling is often employed, which involves reducing coverage of an ETF to the most liquid of the bonds, and is a feature of ETFs such as the iShares Euro Corporate Bond (IBCX), which offers exposure to a range of euro-denominated investment-grade corporate bonds.

Tracking issues

Tracking errors pertaining to the bulk of ETFs and ETNs currently in issue remain relatively small, according to recent research from Morgan Stanley. Despite extreme market volatility, these instruments demonstrated close alignment to most indexes. Last year, the weighted average tracking error for all US ETFs was just 0.39 percent.

This is not to say, however, that negative tracking errors do not occur. Some specialist ETFs, or those subject to diversification requirements, haven’t always fared well, and the process of representative sampling (referred to above) is another factor that can lead to tracking errors.

The Vanguard Telecom Services ETF (VOX) and the iShares FTSE NAREIT Mortgage REITs (REM) both fell short of their tracking indexes last year. Additionally, investors need to remember that ETFs with larger expense ratios tend to have higher tracking errors simply because fees come directly out of investors’ returns.

Interest and distribution payments

Bond ETFs pay out interest through a monthly distribution, while any capital gains are paid out on an annual basis, fewer fees, and expenses. Holders of share-backed ETFs are also eligible to receive payments in the form of a pro-rata share of dividends payable on the portfolio of stocks comprising a given ETF.

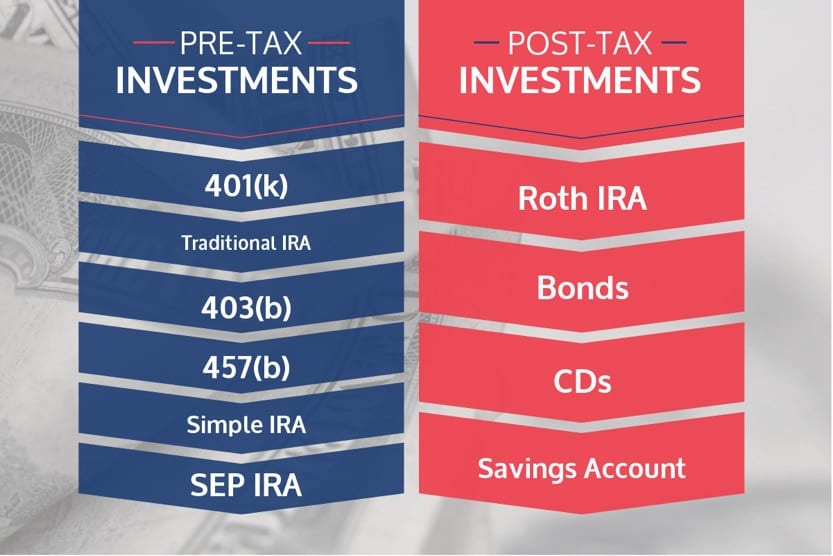

It may be possible in some instances to reinvest your dividend payments. Dividends paid out of an ETF’s net investment income or net short-term capital gains – if any – are both taxable as ordinary income. Distributions of net long-term capital gains, in excess of any net short-term capital losses, are taxable as long-term capital gains.