If you do not have an emergency fund, you’ll want to work on getting one set up. An emergency fund is just that – it is the equivalent of 3 to 6 months of living expenses, set aside in an easily accessible account to be used only when financial emergencies arise. It allows you to handle unexpected bills without incurring debt and can provide a feeling of financial security. Let’s take a look into the details of this emergency fund:

Why do you need an emergency fund?

Unexpected expenses are a part of life. The car will need to be repaired, the water heater will break, jobs will be downsized, etc. When these things arise, the emergency fund will provide a way for you to pay the bills without using your credit cards or incurring another form of debt. It really is a key element in a debt-free living plan. These things do happen in the real world so be ready for them. It will give you a measure of security to know that you have saved up for the unexpected.

Why set aside 3 to 6 months of living expenses?

This is the current “rule of thumb” for an emergency fund. For a family with one income earner, something more in the 6 to 8 month range of savings might be more wise. The whole reason for having an emergency fund is to give yourself a financial cushion. You’ll need to assess your own financial situation and determine how much of a cushion you want to have.

Where do you keep your emergency fund?

You will want to keep your emergency fund in a savings account or in another similar manner that is very liquid and easy to get to, but not so easy you are tempted to spend it.

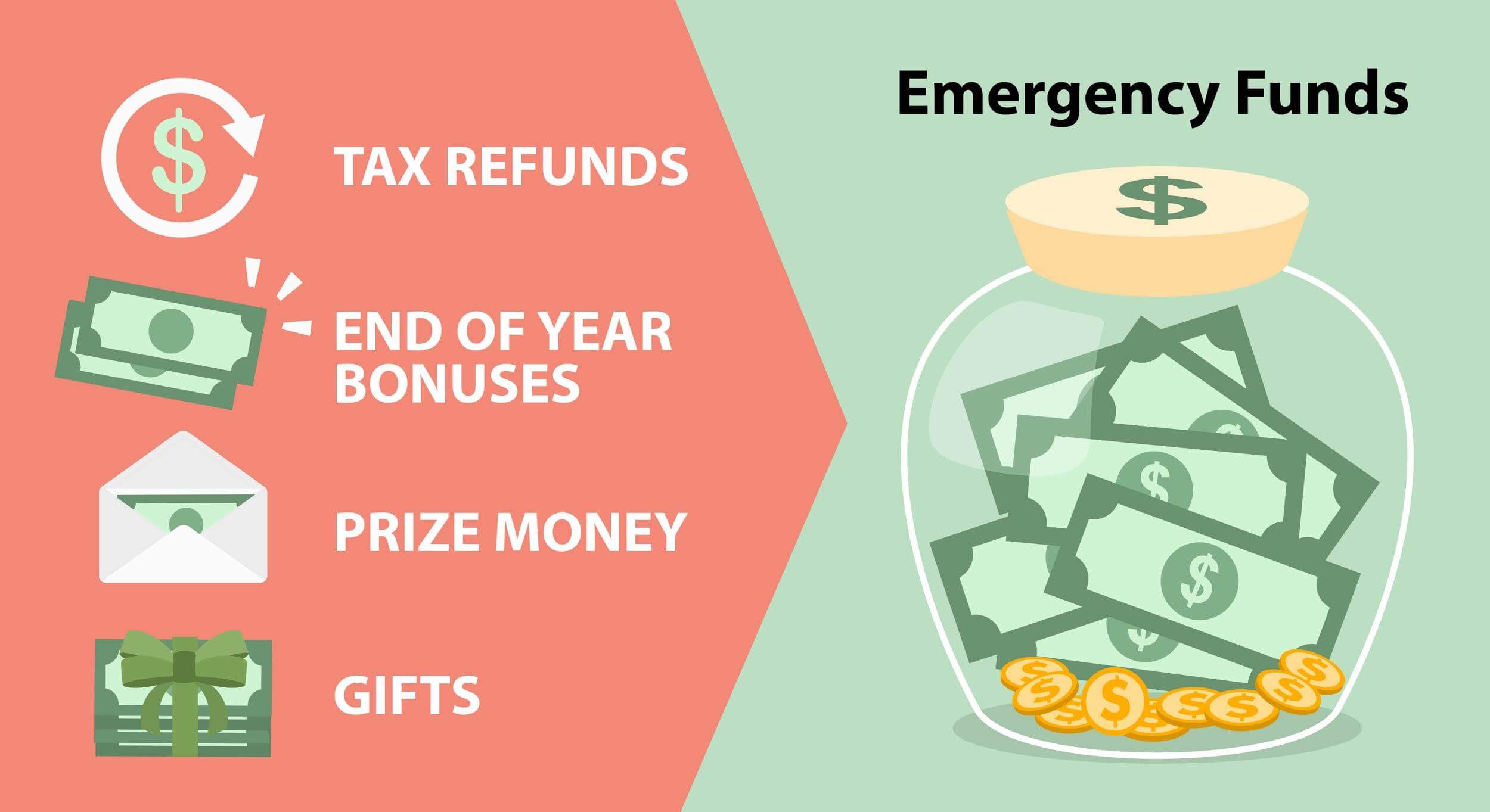

How do you fund it?

Set it up as a monthly bill to yourself. You might want to make interim goals, such as “I want to have $500 saved in my emergency fund within the next 2 months.” When you reach an interim goal, then set a goal for the next phase. Find areas in your current spending where you can spend less, and then use this amount to help build your fund. Use tax refunds, bonuses, overtime pay, or commissions to help fund your emergency fund. One important note here: Do not use credit to build your emergency fund. That is defeating the whole point.

So when have we used our emergency fund?

In the last few years we’ve used our fund to pay for hurricane damages to our home, car repairs to our van, and large medical expenses. Having our emergency fund in place allowed us to weather these large cash outlays without going into debt. We paid money back into our emergency fund after each of these events so that the emergency fund is now back to its full amount.

One thought on “The Basics of An Emergency Fund And Why You Need One”

Comments are closed.