Last week I read an article about the fact that nearly half of the Indian investors don’t know what they’re paying in mutual fund management fees. My concern is that if they don’t know what they are paying, what else are they unsure about.

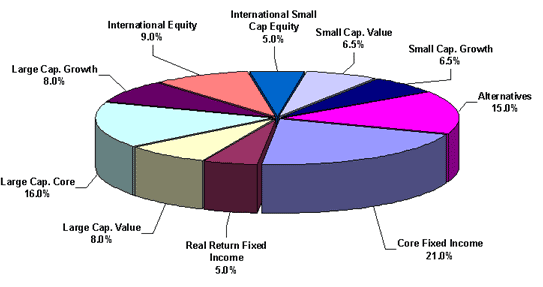

1- Investment Objective

The most important point to consider is the investment objective, first yours then that of the fund you are considering buying. Are you looking for fixed income, growth, assets in the country, perhaps a balanced fund of global assets? The possibilities are endless. It is imperative that you start here.

2- Investment Strategy

Does the fund manager use a passive or active management technique? Are transactions based on the security of capital or growth potential? Perhaps the fund manager has restrictions or timing constraints that dictate his actions.

3- Fund Company

Do you have a preference for a certain fund company? Personally, I believe that certain fund companies are better at managing certain assets. Sometimes it’s the portfolio manager, at other times it is the company’s doing. When looking at the fund company, you are looking for one whose net long-term assets are on the rise. As long as the fund manager has more cash deposited that being withdrawn, he’ll be able to implement his magic.

4- Portfolio Manager

When evaluating a portfolio manager, go with independent assessments such as those provided by ValueResearchOnline. What is the manager’s performance considering the risk associated with its holdings? Does the fund manager take excessive risk, when compared to the index or similar funds, to generate the fund’s results. How long have they been there, what other funds does he manage? What are the assets under management?

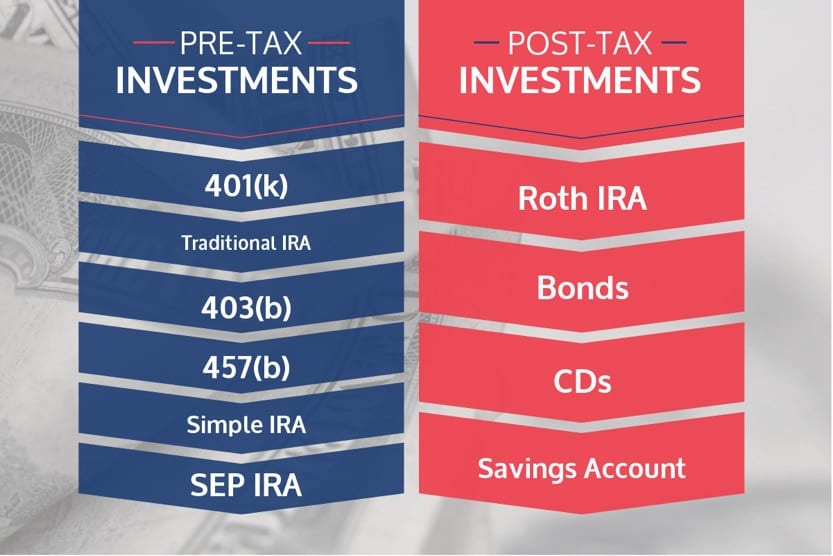

5- Principal Risks

What are the inherent risks involved in the fund? Is it the currency in which the fund is denominated? Geography, sector, market, interest rate or diversification risk.

6- Performance Information

When looking at performance information, look for a fund that has consistently produced above average results over 1, 3, 5 and 10 year time periods. How is this possible? It is possible because funds are compared against their peers, other funds with like comparisons.

7- Fees & Management Expense Ratio

It is not a fluke that I left this towards the ends of the points to consider. This is so because sometimes the most successful strategy and/or the best portfolio manager costs a little more. Also important to know, the performance of a fund is net of fees, so performance rules! This having been said, the lower the fees, the better the fund will do during difficult market conditions.

I am hoping that this article has served to answer some questions investors have about their investments, especially Mutual Funds.