Some time back I went on a trip to the nearby hill station along with college friends. College memories were relived and sudden nostalgia crept in yearning to be college goers once again rather than being part of the cruel corporate world. As usual my friends discussed their personal finance related issues and at one point one of them asked what Asset Allocation is? They had read it at so many times but never knew how to practice it in their day to day money management.

Well , once you begin your investment journey – there were will be 2 major set of things that will plague your mind.

First – making an investment decision without thinking enough (as most of us do, refer a website/ refer ratings and buying a product without any proper understanding). Second thing that would bother you is thinking too much about your investments.

Let me give an example of today’s times. There are many people who continuously think or rather suspect they suffer from disease 1 or disease 2 and would rather go to a doctor’s clinic quite frequently. The doctor would chuckle on your story and by providing you few pills for your mental satisfaction he would be done. That’s it.

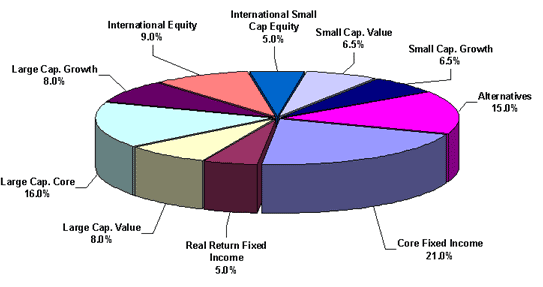

Quite the same thing happens with your investments also. In fact many people also suffer from the same disease that their portfolio is diseased. One of the the most popular type of disease in this field is a faulty asset allocation. Many people often wonder whether their investment portfolio has the correct amount of allocation to both EQUITY and DEBT. Well, there is no perfect solution to it.

Asset allocation is just an exotic/fancy jargons used by professionals to confuse the commons. Rather It simply means investing your money in a manner that suits your needs. That’s it. My friends asked is it that simple to do asset allocation? Answer is Yes.

It is easy provided you are clear about your goals in life – The key to really figuring out your asset allocation is to make a rough work sheet or you may even use an excel sheet –

- List down all the things that you would want to do in life (which involves money)

- Prioritize your goals one by one (strike off which are unnecessary)

- Define when you will need the money and how much for each of your goals one after the other.

Half your job is already done!

What you need to do is to match your investment time horizon to the asset class. Asset classes such as FDs/RDs, then you have the short term liquid/ultra short bond funds and so on in the debt category (if your investment period is really short term in nature ranging from 1 to 12 months). Then you would create a stock portfolio or choose a well diversified equity fund provided your investment horizon is long term in nature (Period ranging from 7 to 10 years and onward)

Let me admit that the example cited above is just a simplified version but what I have been trying here is to make you understand and demonstrate the principals on which individual should choose their asset allocation. There are no set formulae though for right asset allocation but then until and unless you begin the exercise how will you make it simpler for yourself?………..Till then Happy Investing