What is profit-taking on the stock exchange?

In simple words, it is an exit from the current profitable transaction. While the transaction (position) is open, the profit on it is floating, it changes depending on the fluctuations of the quote. When a trader closes a trade, the profit is fixed.

Profit-taking in trading is the most pleasant process when, after closing a transaction, the balance increases due to the fact that floating profit is transferred to it as the financial result of the transaction. This scheme is the same in different markets. Profit-taking on stocks, futures, and cryptocurrencies occurs similarly.

At the same time, it is important to note that a trader can fix a floating profit both with the help of a take profit order (automatically) and manually.

What is take profit in trading?

This is a pending order that must be executed when the market price reaches a certain level. When this happens, a market order is sent to the exchange, which is directed against an open position, which leads to its closure.

For example. You have a long position open on the oil market, yesterday you bought it at 40.00. Today the price fluctuates around 41.00. You send a take profit to the broker at 42.00. This means that if the quote reaches 42.00 tomorrow, a market order for sale will be sent to the exchange. Thus, the take profit will work, your contracts will be sold, the position will be closed, and you will fix the profit from the transaction.

How can take profit be calculated?

In the most general case, there are 2 ways:

- Mathematical. In this case, take profit is calculated according to formulas and proportions. For example, a trader sets a stop loss for 10 ticks. Then he can set a take profit for 15 or 20 ticks. Then the ratio of profit to risk will be 1:1.5 or 1:2 (excluding commissions). This is a rational ratio that you can work with.

- Discretionary. In this case, the trader conducts an analysis, the purpose of which is to identify where it is better to set a take profit.

One of the effective ways is to use the volume analysis and functionality of the ATAS platform to track the activity of large market participants, and then come to a logical conclusion where to put take profit.

What is the difference between a take profit and a stop loss?

These are two very similar pending orders, they are both waiting for their time. In order for them to activate, you need a condition – the price reaches a certain level. Then they are triggered as triggers and send market orders to the exchange opposite to the open position, which leads to its closure.

An important difference is that a stop loss fixes a loss (so that it does not reach catastrophic proportions), a take profit fixes a profit.

There are still some differences between take profits and stop losses. It is believed that:

- Take profits slow down the market, and stop losses accelerate the market;

- Take profits are often placed before important levels, stop losses are placed behind important levels

How to set a take profit?

Take profit can be set:

- during the opening of a position or after its opening;

- manually or automatically;

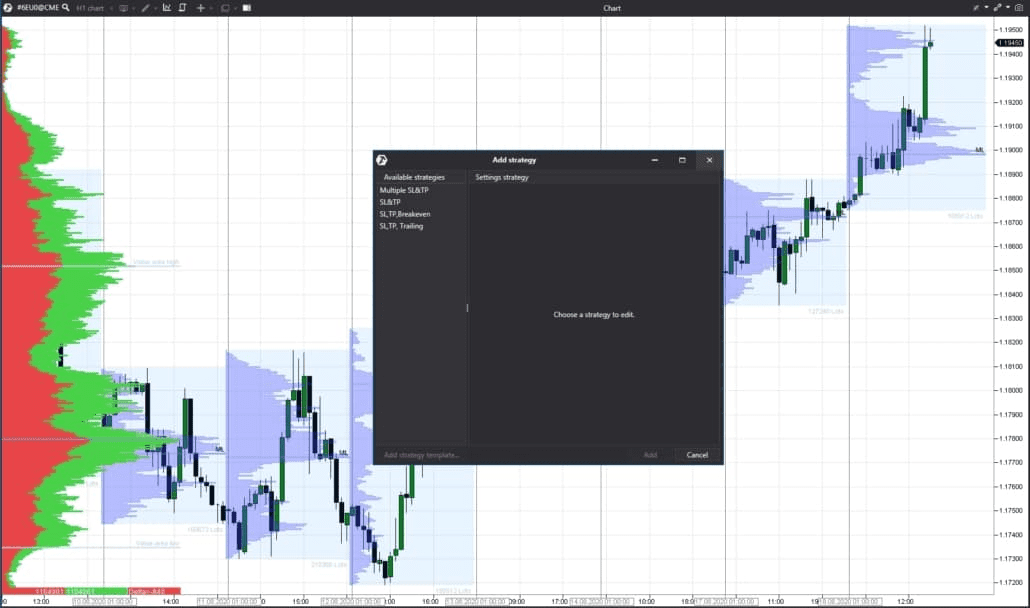

There are defensive strategies in the ATAS trading platform. There you can set up a take profit so that it will be set automatically together with the opening of a position at a given distance.

How to set take profit

What happens when a large number of taking profits are triggered?

At the points where a large number of taking profits are triggered, the market slows down.

For example, large traders are in purchases. They placed take profits below an important peak. When the price reaches the take profit level, sell orders begin to enter the market to close previously opened purchases. As a result, the uptrend may slow down, or even reverse. Because of this, sometimes there are ”shortfalls” of the price to the previous important levels.

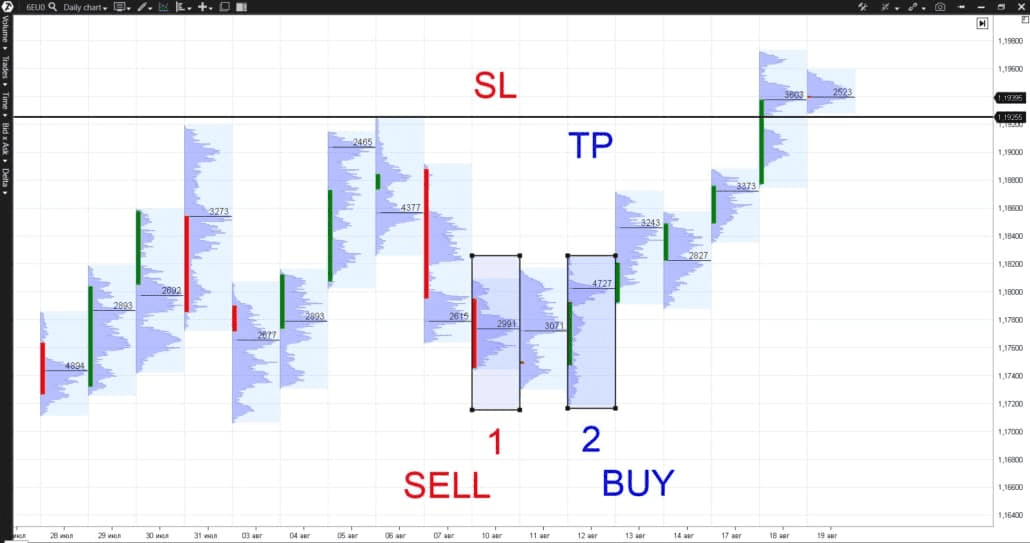

Where are take profits often placed?

A popular place to place take profits is a price zone located near some important level, but not reaching it.

Where to place take profits

Sellers at point 1 are likely to place their stop losses for the previous high. And buyers at point 2 are likely to place their take profits before the previous high.

Another place to place take profits may be the levels at which stop losses are presumably set. Then stop losses will be reduced to take profits.

Where to place Profit Taking

Take profits placed in this way to have increased profit potential, but also a lower probability of execution.

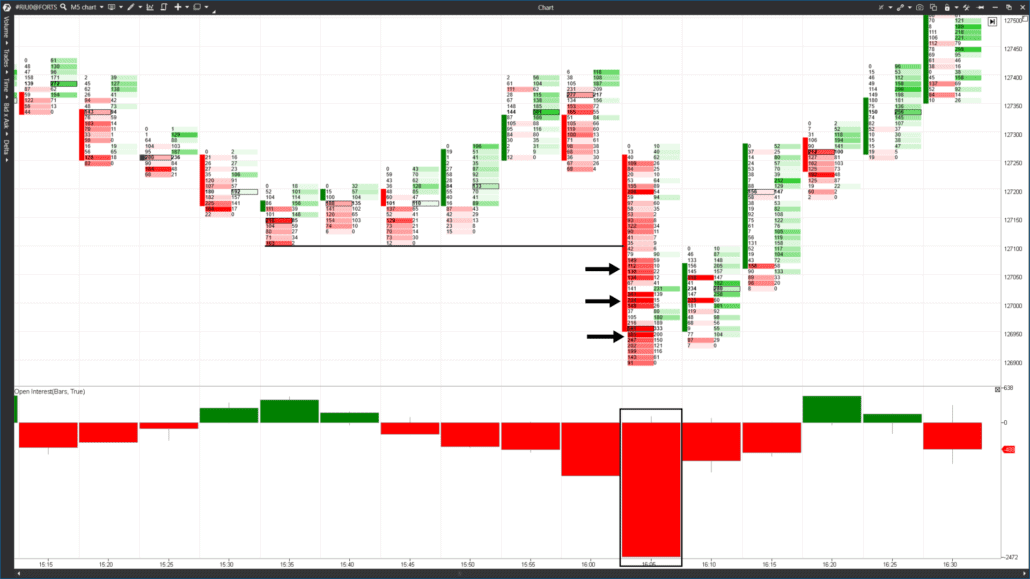

When taking profits and stop losses are triggered massively, you can see a noticeable drop in open interest.

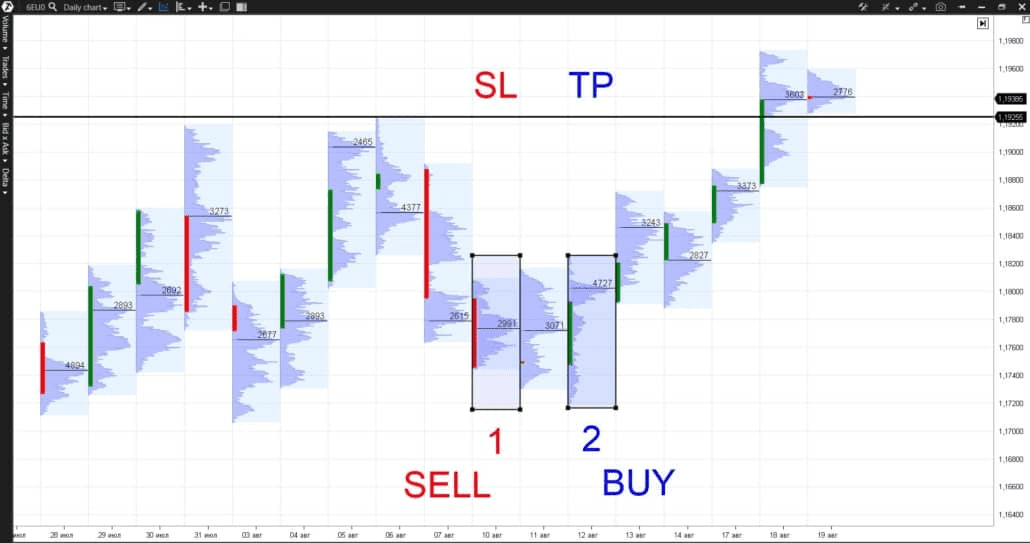

How Profit Taking works

What do we see in the picture above? When the previous low was broken, a large number of market sales were sent to the market (this is evidenced by the red clusters). Obviously, numerous stop-losses of buyers have been triggered. Some of them were combined with the sellers’ take profits.

As a result, we are seeing a sharp drop in open interest, which indicates the exit of a large number of traders from the market.

Principles of Profit Taking

The general principle that will help in using take profit is“ “Cut losses, and let profits grow.”

The first part of this principle refers to the ”brother” of take profit – stop loss.

Stop loss should be clearly limited, and if the market goes against your position, then losses should be cut without regret, closing a losing trade. Sitting out losses, hoping for a price return, or emotionally averaging an open position, while also increasing the volume– is the way to lose the deposit. Losses need to be cut at the lowest possible level.

The second part of this principle already directly concerns take profit.

Place the take profit in such a way that the profit has the opportunity to grow. You need to give the market the opportunity to move in the direction of your transaction.

It is desirable that the take profit exceeds the stop loss several times. Give the market time to bring you a significant profit, set take profit at sufficiently remote levels.

Learn the trailing stop technique. This is a method of tracking a successful transaction, in which the trader moves the stop loss following the price going in his direction. So the trader protects the achieved profit, but does not limit the potential for its further growth.

Of course, there are different trading systems for exiting trades, but the main principle “cut losses and let profits grow” has passed the test of time and has been used by many well-known traders.

Conclusions

Correct profit taking is very important in trading. So don’t forget that:

Take profit (exit from a trade with a profit) should be clearly described in the trading system, and its effectiveness should be tested on history;

Indicators for volume analysis in the ATAS trading platform help to find levels for effective take profit setting;

It is desirable to set a take profit according to the general principle“ “Cut losses, and let profits grow.”