Simple and easy is it? No ways that would be your first reaction. In fact, many investors make the mistake of doing too much to their investment portfolio. Why can’t we do it the more simple way –you will probably ask me how? Well, you can do it provided you stick to some basic principles of personal finance management lessons.

Invest in the minimum possible number of financial instruments. It also means taking the fewest possible actions.

In the last decades or so, the investment culture and methodology has undergone a sea change. People have somehow gradually shifted towards being a worshiper of complexity. As I had mentioned earlier in my previous article “simple seems quite complicated” for most of the people holds quite true in today’s times also. More and more investors assume that any investment methodology that doesn’t involve any sort of mysterious formulae,complicated complex products and elaborate charts can’t possibly deliver them the goods. The truth, perhaps, is quite the opposite. Today I will talk about the same through simple time box. Why time box because each of your investments should be centered around investment time period only.

Time Box Number 1: – Keep all the money that you might possibly need for at least the next 1 to 5 years in safe fixed-income investments .Like investing in to a liquid fund to ultra short bond funds and other debt products. The idea is simple safety is the key while taking minimal risks with your money.

Time Box Number 2: – Long-term investments which exceeds a time period ranging from 5 to 7 years should be allocated to a balanced or conservatively run equity funds with a good track record.

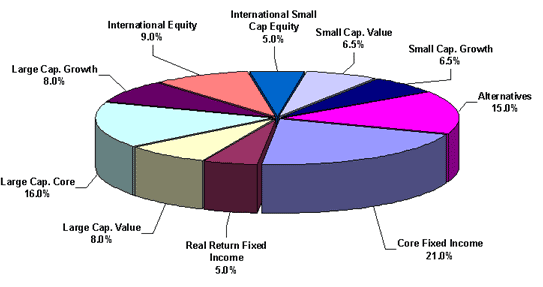

Time Box Number 3:- Very Long term goals (like retirement planning goals) exceeding say 7 years to 20 years should be allocated to a mix of multi cap/a mix of small and mid cap too. This will diversify your portfolio and help you compound your returns with times.

Always note investments in equity should be gradual—moving lump sum money received through annual bonuses into equity-backed investments in one shot when the market is on a high can lead to disaster! Instead learn to park your money gradually form a liquid fund to an equity based mutual fund stretching over a period of 18 to 24 months. This way you will minimize the volatility risk.

Apart from these 3 time boxes there’s insurance to think of however insurance is not an investment at all. It’s an instrument that buys you peace of mind. In the Indian context though we end up buying this product as an investment tool often missold to millions !!! Make a liberal estimate of how much money your family will need if you fail to wake up tomorrow morning and buy the cheapest term insurance you can find. Buy an appropriate life cover based on your liabilities.

In a nutshell keeping things simple can help you go a long way – it can help you pick the right investments provided you choose your appropriate time box and helps you understand your requirements before putting your money in to the “BEST” of the products. Simplicity is needed not just in the types of investments that you choose but in your investment portfolio as a whole. Today every 9 out of 10 people should have basic emergency fund/a huge term plan and not more then 3 to 4 mutual funds that’s all. Everything should be centered on reaching your life goals after all that’s what you want in the life right…….. Till then happy Investing