When facing home foreclosure, many debtors feel like they are out of options and turn to a bankruptcy filing. Although a bankruptcy filing prevents home foreclosure, it is not the best solution. There are several methods you can attempt before resorting to bankruptcy filings in order to protect from foreclosure.

The first path that you should always try is dealing with the creditors directly to figure out a payment plan. Although creating a new payment plan may result in expensive payments for the short term, that is better than foreclosure. If you have repaired your financial situation but are still facing foreclosure, this may work for you – you can work with the creditors to pay in the short run to protect your home, and then go back to the prearranged payment plan in the future.

If you cannot create a new payment plan, then you can still use the property to try to pay without losing the home. There are several types of deals you can make with a creditor – for instance, you could try to modify the mortgage, sell the property to a third party or the creditor directly at foreclosure in order to pay off the debt, get a second mortgage to pay off the current debt, or buy it back from foreclosure yourself. However, all of these plans involve negotiations with a foreclosure expert and creditors, and you must be certain that this is the right path for you. Often, homeowners do not see that stopping foreclosure is just a short-term fix to a long-term problem – that they cannot afford that house – and spend a lot of money preventing foreclosure rather than moving to a more economical house.

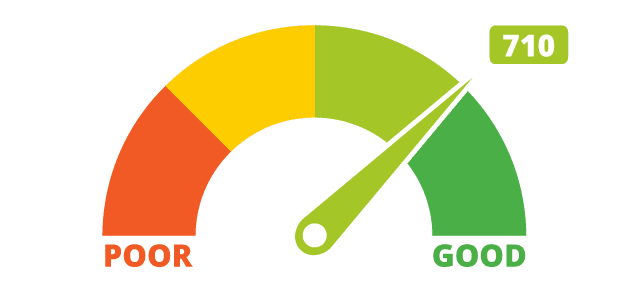

However, filing for bankruptcy will prevent home foreclosure. This can be good for two reasons – it buys you more time in order to try to stop foreclosure, or if you actually continue through with the bankruptcy process, then it will protect your house and certain other assets from being taken. However, it will come at the usual cost of bankruptcy and will be on your credit report for the next seven to ten years.

Although it is important for you to talk to a foreclosure expert before making any decision, it is good to know that there are plenty of possibilities out there to protect your home from foreclosure. You must try to determine which path is best for you in your situation and work to try to prevent foreclosure.

Note: Bankruptcy can result in a stay from foreclosure. Homeowners lose that stay once they leave bankruptcy protection.