It’s that time of year again. A summer full of partying, baking in the sun, and maybe even a job (heaven forbid) is coming to a close for hundreds of thousands of college-bound Millennials.

Retail companies love them because they are prepping for the big move by spending, or convincing their parents to spend, millions on MacBooks, iPods, iPhones, furniture, and the latest in trendy clothes. It’s no secret that credit card companies love them too. On-campus events are filled with local banks and credit card issuers giving away free subway sandwiches, glow-in-the-dark pens, and floating keychains just to attract their business.

You may wonder why credit card companies are so interested in targeting a demographic that statistically has minimal income and a lot of debt while in school? The main reason is these consumers are generally lifelong customers who will keep spending and spending, even when they have nothing to spend. It’s a proven fact that the first card in a student’s wallet will stay there for a very long time, and even if they do default, parents are often willing to step up and bail them out.

56% percent of undergraduates get their first credit card at the age of 18, and 91% of students have at least one card by their senior year. The average outstanding balance on undergraduate credit cards was $4,169 in 2010, and that number continues to increase at a dramatic rate each year. Add the credit card debt on top of students loans and Millennial students are beginning their lives in the “real world” in a real deep hole of debt.

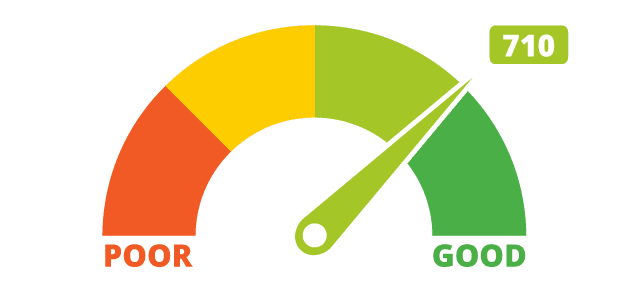

The problem is most college students get their first credit card at the young age of 18, but many have never been taught how to properly manage credit and establish a solid credit score. It’s not taught in High school classes, and parents often fail to teach their children the importance of credit and its role in their financial future. There certainly aren’t any step-by-step directions in the credit card application either. As a result, tens of thousands of college graduates enter the workforce each year with a lot of debt, poor credit scores, and a rude awakening when they apply for a loan on their first car, condo, or home.

If you are a college-bound Millennial, or a parent of one, keep the following five tips in mind as you head off to freshman orientation this year. They will not only save you from headaches later on, but they will also save you a lot of money.

1. Beware of freebies with strings attached

Nothing is better than free stuff. But if you have to fill out a card with personal information before they give it to you, you’re better off moving onto the next booth. Don’t fall prey to a free sandwich that will reward you with an unexpected credit card in the mail two weeks later. You’re smarter than that.

2. Don’t sign up on the spot – Do your research online!

There are many reputable companies providing excellent cards for students at on-campus events; however, signing up on the spot is generally not a good idea. Take the informational pamphlets home with you, and then do a little online research to find the best possible card. The online credit card marketplace provides consumers with more power than ever to compare and contrast the best offers in the industry and apply securely online in about 60 seconds.

3. One card is enough

Once you have found the perfect student card, keep life simple. One credit card is enough for a college student. Set up your account online, keep your credit utilization under 30% of the credit limit, and pay off your balance each month. If your limit is too low at first, use cash or a debit card to pay for anything that would take you above the 30% threshold. When you are prepared to responsibly manage a higher credit limit, call your credit card issuer and they will likely be happy to increase your limit.

4. Imagine you never heard of a Cash Advance

If you ever need quick cash, your credit card is generally not a good option. Forget about it. Interest rates for cash advances could be up to 30%, which is highway robbery. Sell old textbooks back for cash, throw something you never use on craigslist at discounted price, or call good-ole Mom and Dad to give them the sob story. Anything is better than paying 30% on a cash advance.

5. Educate Yourself

An integral part of every college student’s education should be developing an in-depth understanding of consumer credit and how it will affect their personal financial future. Take 15 minutes to browse the net and provide yourself with an important education you won’t receive from even the best Ivy League schools.