Analysts at Goldman Sachs wrote that the cryptocurrency market is already catching up with the traditional financial market in terms of volume and amounts to $1.87 trillion. Apple, Amazon, and Walmart have announced the search for specialists in cryptocurrencies and digital money. Where will the company’s interest in crypto assets lead?

Who goes to the crypt?

On August 15, the largest retailer in the United States, Walmart, posted a vacancy on its LinkedIn profile about finding a leader in digital and cryptocurrency products. Based on the job description, this person should develop a “digital currency strategy and a product roadmap.” The specialist should also be responsible for partnerships related to cryptocurrency. The announcement does not specify which products the future Walmart employee will launch.

This vacancy was published a few weeks after Amazon, one of the world’s most prominent players in the e-commerce market, announced the search for a leading specialist in digital currency and blockchain products. According to the job description, it should be an employee who will develop a digital currency and blockchain strategy for Amazon and a product roadmap. One of the necessary skills of a candidate, which Amazon indicated, is “the ability to succeed in an uncertain and constantly changing environment.” According to a London newspaper City A.M. source, Amazon’s plans are broader than just accepting cryptocurrency for payment: in 2022, the online retailer will create its token.

At the end of 2021, Amazon will start accepting bitcoin as payment — it will be the first of about eight cryptocurrencies that Amazon will work with, the interlocutor of City A.M. noted. According to him, the company will later start working with cryptocurrencies like Ethereum, Cardano, and Bitcoin Cash. At the same time, Amazon denied these rumors and reported that the speculations that arose around the company’s specific plans for cryptocurrencies do not correspond to reality.

The British bank Lloyds Banking Group also published a vacancy in the search for a senior manager for digital currencies and innovations in mid-August. The announcement says the company is looking for an expert in cryptocurrencies and blockchain who will work on new projects for the bank.

Even earlier — at the end of June — Apple posted a similar vacancy. Among the essential requirements for the position of manager for the development of “alternative payments,” the corporation indicated five years of experience working with digital wallets, players in the “buy now, pay later” segment (Buy now, pay later, BNPL), fast payment services, cryptocurrencies, etc.

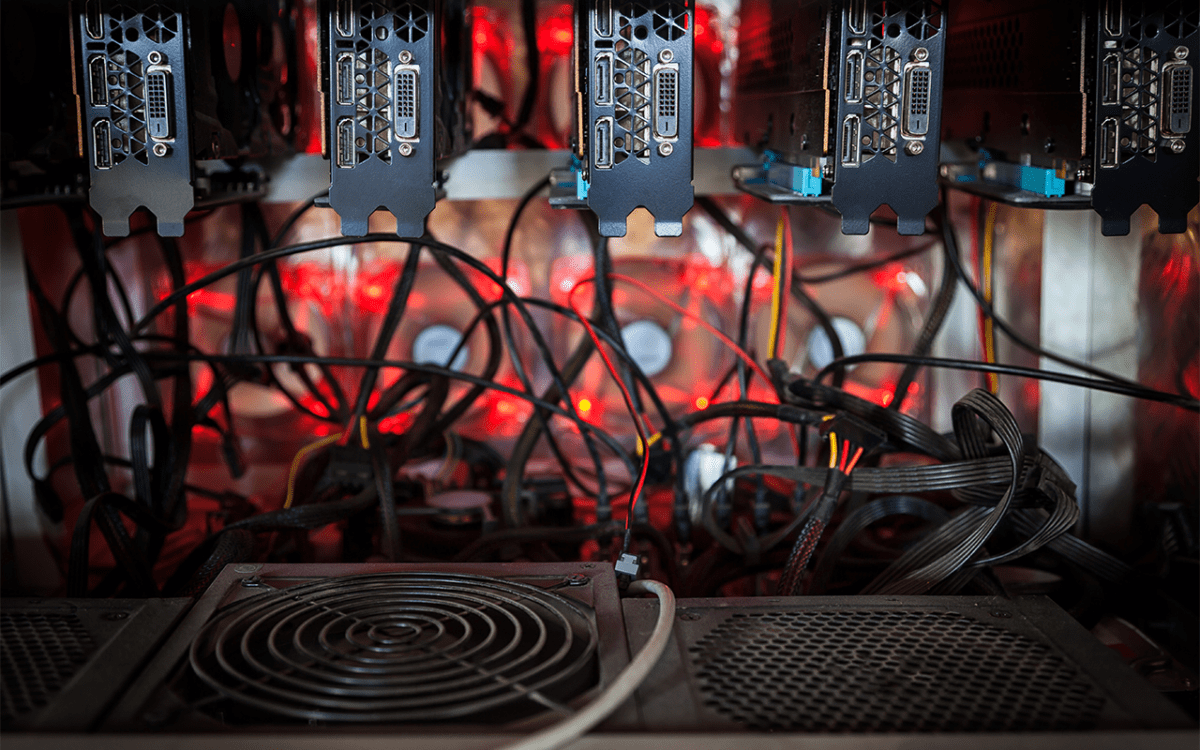

Some large companies already accept cryptocurrency as payment for goods and services. Starbucks and a large chain of Home Depot construction stores accept cryptocurrency through third-party applications that convert digital money into dollars, The Wall Street Journal reported. Payment in bitcoins was also accepted by Tesla. Still, the company’s head, Elon Musk, soon suspended the experiment because cryptocurrency mining is too harmful to the environment. At the end of July, Musk said that the company would most likely start accepting bitcoins again after conducting a comprehensive check of the amount of renewable energy used to extract the currency.

Why is this necessary

Today, the cryptocurrency market is already catching up with the traditional financial market in terms of volume, Goldman Sachs (GS) analysts write in a report dated August 11 (Forbes has it). According to CoinMarketCap.com, there are about 6,000 cryptocurrencies on the market, with a total market capitalization of $1.87 trillion. For comparison, the total market value of bonds covered by the Bloomberg-Barclays US Corporate High Yield Index is $1.67 trillion, while the market capitalization of the S&P 500 is approximately $39 trillion, according to GS.

Analysts write that cryptocurrencies are a highly competitive market compared to other asset classes. The most popular digital currency is bitcoin-it accounts for 46% of the entire cryptocurrency market, and another 20% is occupied by the second most popular, Ethereum. The shares of the two largest companies (Apple and Microsoft) in the S&P 500 account for about 12% of the market capitalization. According to GS, the shares of the largest 84 companies account for 66% of the total market capitalization.

Facebook was a pioneer in the cryptocurrency market among large companies. Still, it tried to launch a digital currency at the wrong time. In 2019, it was crushed by the state regulator, which is afraid of losing its control, according to Alexander Brazhnikov, executive director of the Russian Association of Crypto Industry and Blockchain (RAKIB). However, the pandemic has changed the situation; he continues: online solutions are becoming more popular, and now it is difficult to resist such initiatives, says Brazhnikov. According to him, the world is moving towards the fact that cross—border companies can get away from the dependence on states and their currencies-the dollar, euro, and ruble.

“Why should Amazon receive payment in different currencies, if the company can make its own tokens, for example, Amazon Coin and receive payment in them?”, the expert argues.

Amazon can teach people to buy in their currency if it encourages customers with discounts when using tokens and then begins to cooperate with other companies, predicts Brazhnikov. Such a development strategy will lead to the fact that shortly companies will not depend on any state, Central Bank, or regulator but will sell and form prices for goods and services themselves, the expert is sure.

Now retailers, as a rule, accrue points to customers for purchases on their sites, and creating their cryptocurrency will help them replace these points, says Rustam Botashev, portfolio manager of the Hash CIB investment company. Companies may want to sell some tokenized goods in the form of an NFT (non-fungible token, non-interchangeable token) or launch a marketplace, Botashev suggests. Experiments with cryptocurrencies are a win-win situation for large companies, which either will not affect their development in any way or will only affect them positively, he is sure.