The internet is, without doubt, the greatest technological breakthrough that mankind has ever seen in the last couple of decades. With the internet, we are able to speed up communication significantly that we have nearly rendered the old mailing procedures as obsolete.

Another interesting benefit that we have got from the internet is the fact that every single individual has an equal standing online. This, of course, is in reference to business. The internet has basically transformed the entire business arena into something that even those with little financial prowess can take part and dominate. Aside from these, there are a whole bunch of other advantages of the internet in relation to business and entrepreneurship. Here are some advantages:

The customer base

The internet has virtually made the world a smaller place. With it, internet business advertisements can be seen by billions at any given time. Of course, this would translate to buyers, clients, partners, and customers.

24-hour service

The internet never shuts down; the website coordinators do, but their apps are always awake ready to accept orders.

Networking

With the internet, you will be able to create reliable links with people all over the world. You can have business partners who can help you out at any given time.

Inexpensive

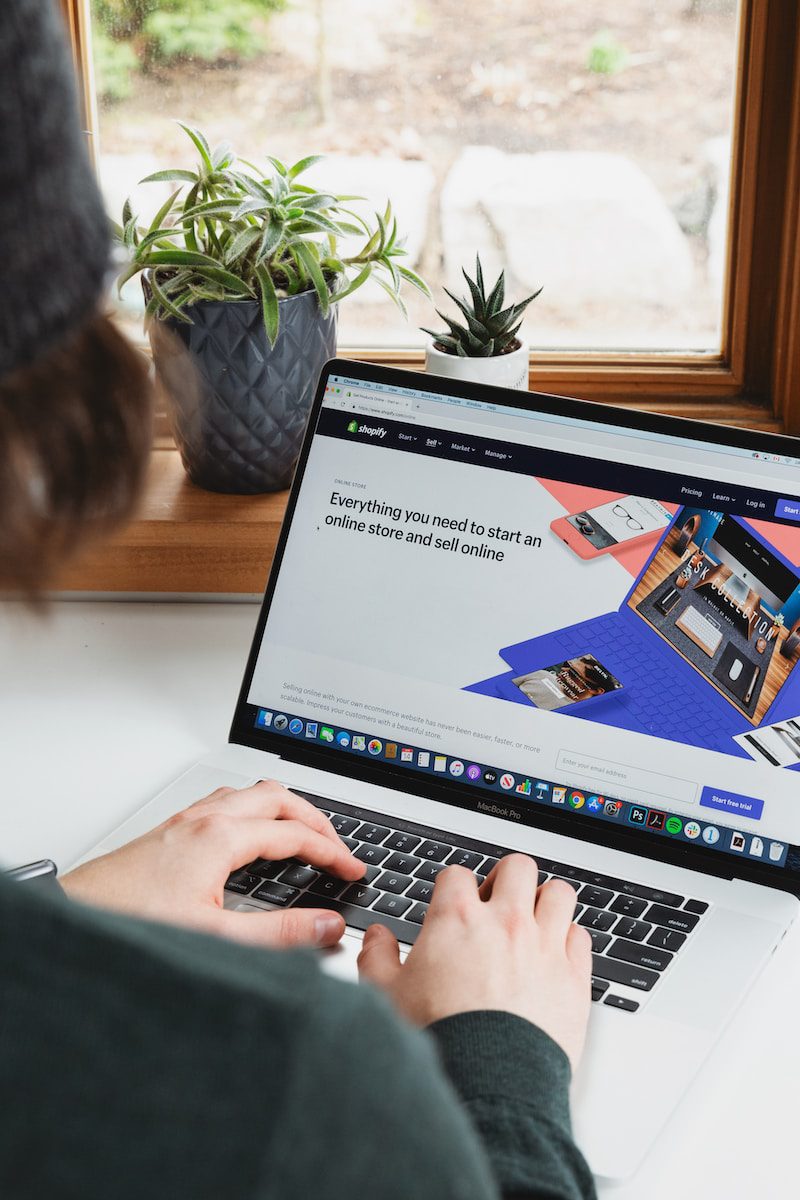

The cost of putting advertisements online is the prime reason why the internet business has become tremendously popular in the last couple of years. Internet Businesses with small capital can put their ads online and they can still expect billions to see it. Indeed, putting an online store will only cost several dollars annually.

Simplicity

There are hundreds of applications and software that make selling and advertising fairly simple. You do not need to hire a specialist to be able to sell products. As a matter of fact, you can work alone and still manage to sell.

Low maintenance cost

If you create your own store, you will be spending a lot just to build your store. Add to that, you still need to pay internet, electricity, and water bills. The same cannot be said of an online store.

Easy decision making

Another interesting advantage of the internet business is that you can afford to switch focus. In other words, you can sell decors today, and you can sell packaging supplies tomorrow. You can do this with relative ease and at no cost.

Passive income

Passive income means you earn money while you sit idle. Some websites who are accessed by thousands of people every day earn a lot of money; and they are not even doing anything.

Choose your market

It is easy to choose which group of people to whom you will sell your market. Indeed, if you decide to target another audience, you can do so easily. There are a lot of social networking sites which would allow you to reach out to as many customers as you may like.

Globalization

Basically, the internet was solely responsible for creating a global community. With a single click of the mouse, you will be able to sell products to millions of individuals as though they are with you.

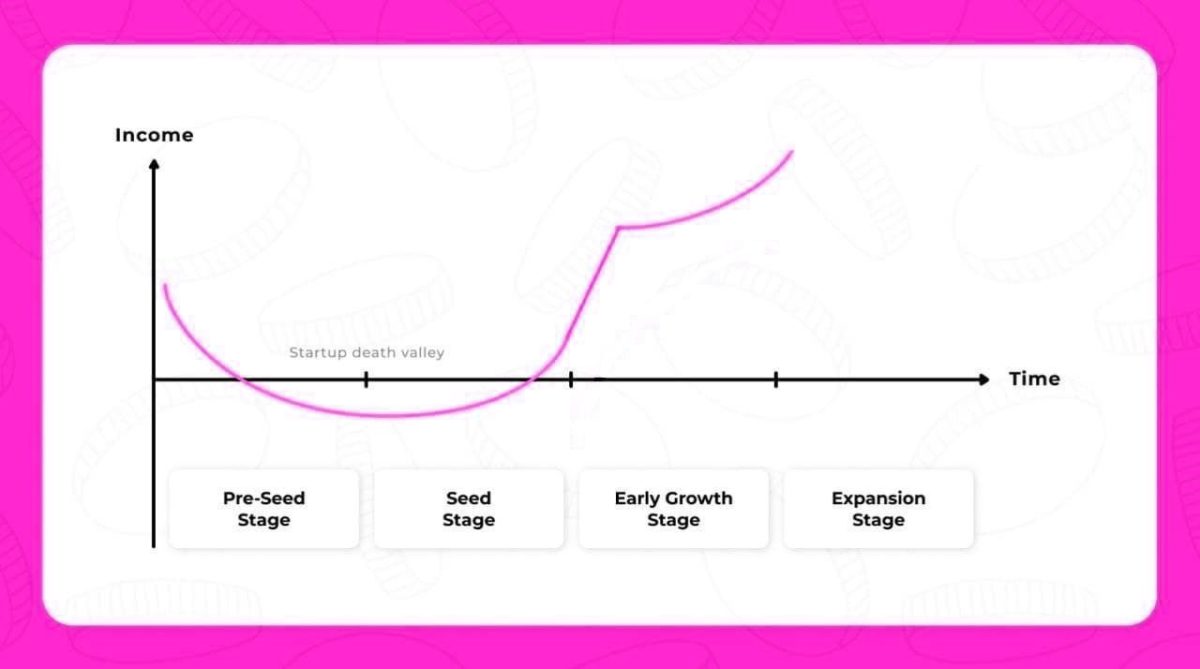

Despite all these advantages, an internet businessman must still be very patient. He must understand that with the ease and comfort comes intense competition. Indeed, if you do not work hard enough, you will be outmatched by the others, and your business will die.