Every company goes through a certain development life cycle, and each stage has characteristics that significantly impact the quality of the investment and the result. To understand more clearly the return on investment, the nature of asset price movements, and other interrelationships, it is important to correctly define the company’s stage of life.

The main stages of a company’s development

Idea development

Every company begins with an idea and the development of the first product. This is the most interesting stage for venture capitalists and the least interesting for investors in public companies. At the very beginning, the future company refines its strategy, develops its first product, and finds its first money for development.

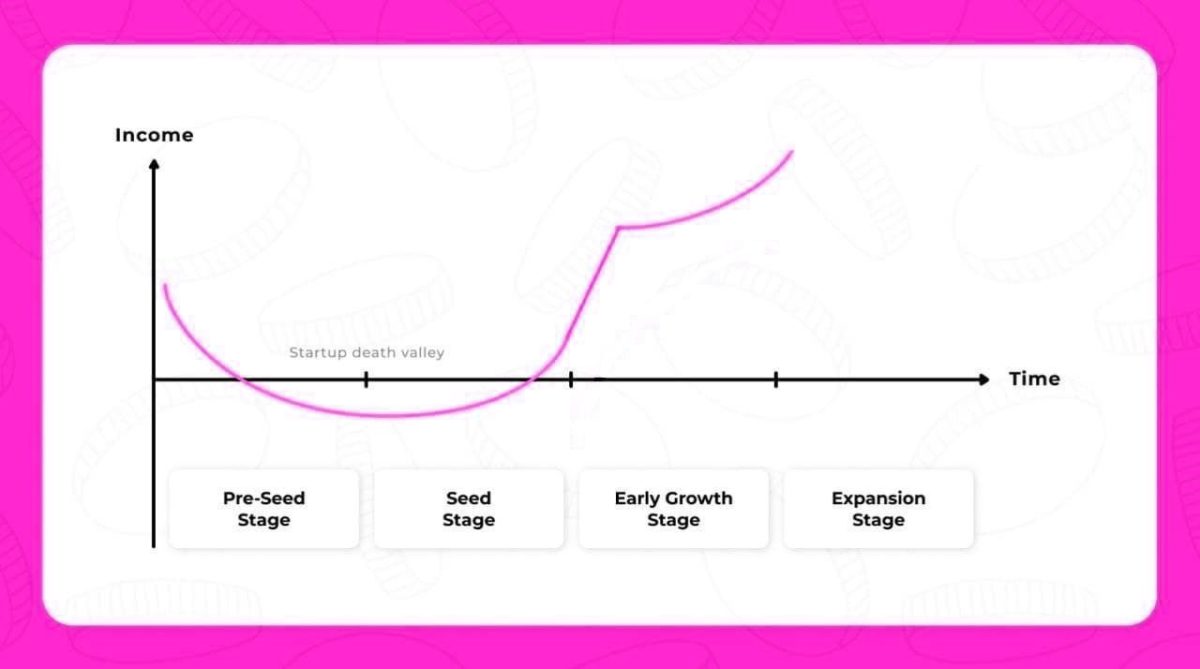

This stage is characterized by experimentation and great uncertainty. About 90% of startups close in the first year of their life and do not pass the “valley of death.” However, future large companies usually pass it and reach a new level: finalizing products and starting their first large-scale sales.

Business Development – Expansion and Peak Growth

After an idea is finalized and a medium- and long-term development strategy is defined, the company begins to work on its scale: it enters new geographic markets, acquires other companies, invests in new marginal products, etc.

This process is the most interesting for investors. As a rule, many companies go public through an IPO precisely at this stage. The company’s logic is simple: the IPO allows the company to receive money from the placement and the opportunity to use it to accelerate development further. Also, at this point, the investor gets a bigger yield due to the rapid growth, with still existing significant risks: until the first profit, the company is in the ranking of “idea” and “bright future.”

Reaching the maturity and stability of the business

With the appearance of the first profit, dividends and business risks decrease, and the company comes close to its peak development point. For investors, this type of business moves from the ” growth ” category to the “value company” category.

The absence of significant growth characterizes this stage of business development. The company has implemented all of its large-scale projects and has come to the state of a stable business unit with well-tuned business processes.

As a rule, clients of such businesses are constant. Developments and innovations are of a point-by-point nature.

Conclusion

Each company is at a certain stage of its development. This stage of life has several important features to consider when investing. We have identified three stages of business development: the startup stage, the development stage, and the maturity stage. The second and third stages of business life are the most interesting for investors in public instruments. In the second stage, the company becomes a “growth story,” which stands out for its high potential returns and risks. In the third stage, the business moves into the “value” stage with more predictable cash flows and lower target returns.