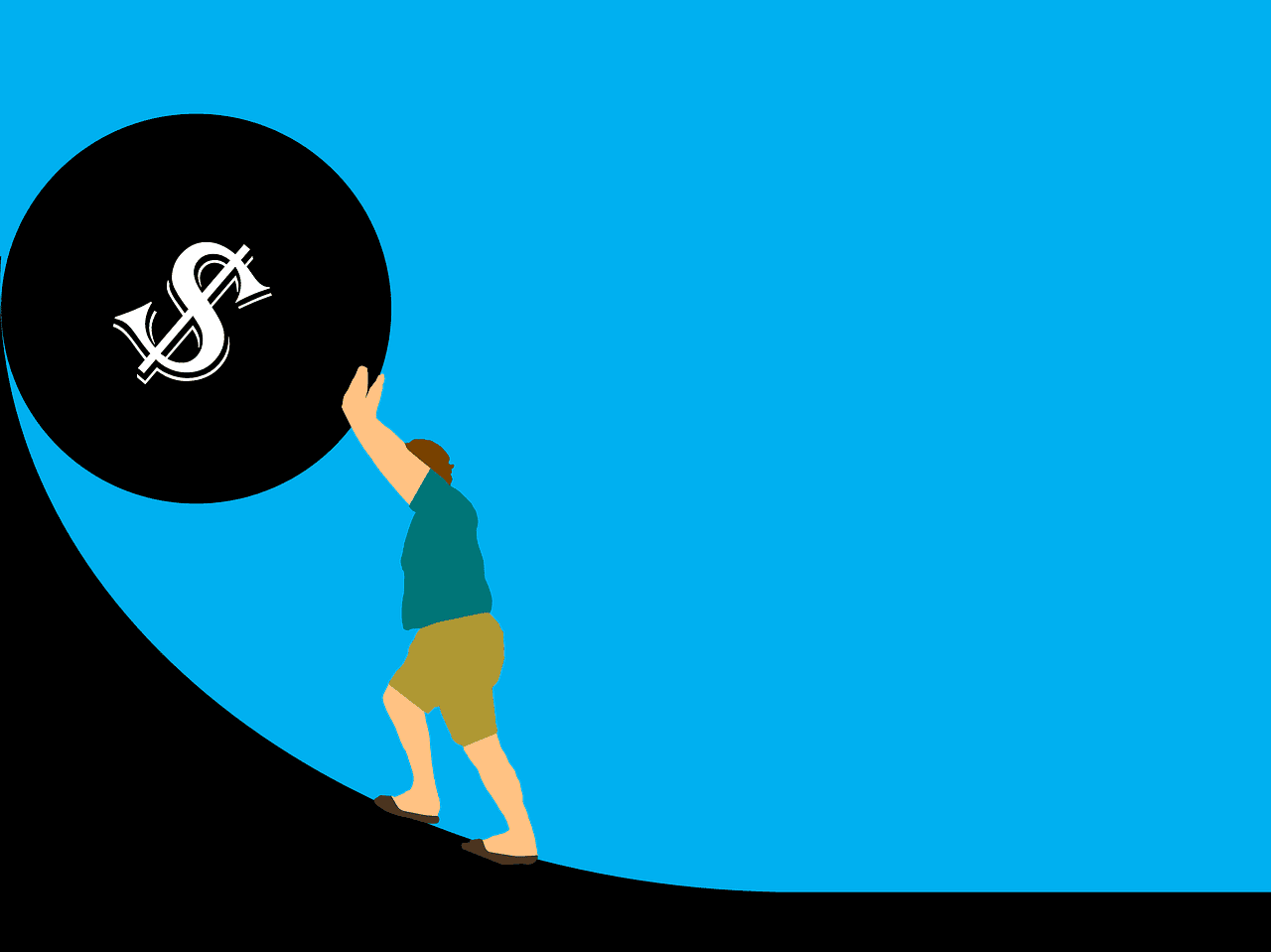

Conservative estimates place it around 70%… while others believe it is closer to 95%… the number of investors who “fail.” I suppose it shouldn’t shock us… after all, whenever you talk with a Mutual Fund representative, if they’re doing well, they will point you to the fact that they are in the 1st or 2nd Quartile – meaning, the fund they manage has returned more than 75% or 50% of the other fund managers’ portfolios. Obviously, there must be several then who are in the 3rd or 4th Quartiles (the bottom).

There are several reasons why investors fail and today I thought I’d share a few more.

It’s perplexing… the number of investors who continually lose money trading, but for some inexplicable reasons, continue to trade. I suppose a variety of reasons exist, including poor money management (high commissions on small positions eat away at any profits), the delusion they have the skills and knowledge to trade (after all, isn’t everyone else getting it?), or addiction to trading (like gambling, just “sanctified.”).

Some, in sheer frustration, choose to pay hundreds and even thousands of dollars for trading software that promises every success… so they get split screens, subscribe to live news feeds, etc. and still struggle to make money trading. Then they flood their email inboxes with a plethora of free newsletters… worth every penny!

I’m not slamming these individuals… after all, most of us have had experiences like these somewhere along the line. But I am concerned for you if this is your current experience… and I’d like to help.

I think one of the most fundamental reasons why investors fail and why people are losing money in the stock market is because they are trading rather than investing. Perhaps this is so subtle you think I’m trying to create something out of nothing… but hear me out for just a moment. When you think of the term “trading”, what comes to mind? A transaction, a swap, buying and selling, dealing, etc.

Now, when you consider the term “investing” what comes to mind? Yes, some of the same elements of purchasing and transaction but with an added component of you having to “put something into” the transaction. Investing seems to require more than to merely trade. And you’d be right…

If making money in the markets was as easy as trading this stock for that one, and then exchanging it again for another one, we’d all be successful… but very few do this well. Instead, the average Weekend Investor needs to do less “trading” and more “investing.” You’re going to have to put something extra into the transaction… considering the fundamentals of a stock, watching the technical indicators, and keeping track of your “investments” because these investments of time, work, thought, consideration, management, etc. will all determine how successful you’ll be as a financial investor.

I realize most of you don’t have the time to do this on your own… hence, you should stop trading and simply buy the index when you have the money you can spare.