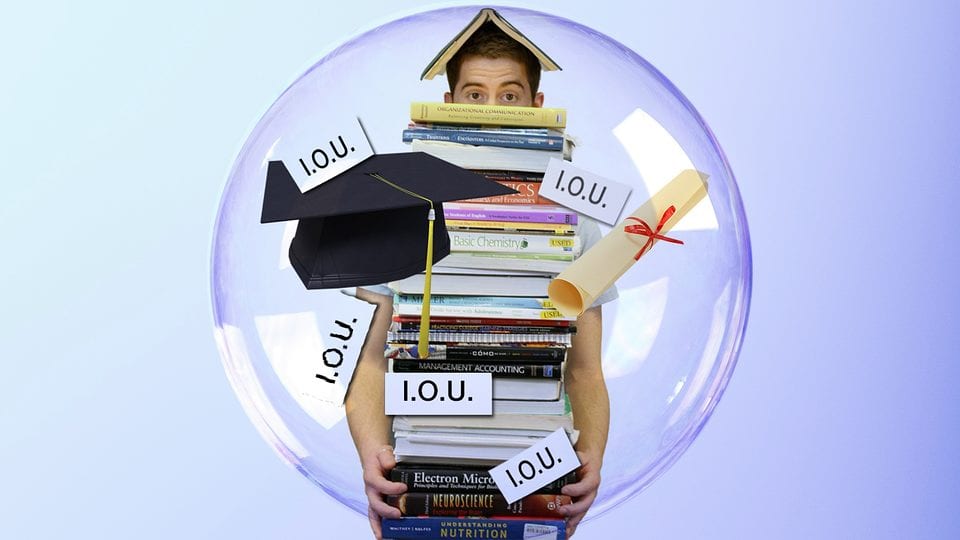

As if college weren’t hard enough, getting out of those hallowed halls may be the lesser of your worries. Once you leave the grounds you are faced with the challenge of finding a job – or starting a business – in your new career path. This is much easier said than done since most companies want experience and, unfortunately for you, most college training does not count toward that so-called “real-world experience”. It’s a problem because now that you’ve completed school you have something that is common among a majority of college students: debt.

You struggle to create a life for yourself, and the moment you are out the starting gate you’re confronted with immediate hardship. You’re most likely well aware of debt by now in this stage of the game, but credit cards and some utilities aren’t even a comparison to the possibility of several hundred thousand dollars in school loans. Without a job you certainly can’t repay it in a timely manner.

Though you may figure it can wait, your college debt is not going to disappear, so there is no good reason to postpone the process of repayment. It’s important to realize the critical nature of debt repayment. It’s also smart to be aware that many companies have added a policy to check potential employees’ credit records as part of their pre-hire considerations. So beginning to pay off that loan is in your best interest.

Student loans are typically deferred for at least six months upon graduation. This can, unfortunately, motivate the proliferation of “professional students” who are afraid to complete college, fearing the financial trap of their loans despite running up even more charges. Don’t continue in school simply to postpone the repayment of your college loans. Have you begun to pay it or rather, like most, looked at it then casually discard it into the “I’ll pay this later” pile? Granted, having no job means paying is hard if not impossible. However, a college debt, as well as your other loans or credits, impact your credit rating. So even if you can only pay $20, do so. It’s a start.

The simplest way to get to that debt is to develop a budget plan. Make a list of all your fixed bills like car loans, rent, personal loans, etc. and add to that list your variable debt like credit cards. Prioritize the list and compare it against any income you may have. For some bills, you can briefly postpone them or work with a creditor to lower payments over time or even ask them to temporarily stop charging you interest. Whatever money you have left should be allocated, at least partially, to your student loans.

Unfortunately, the time to pay the loan without hardship may be long past. If you’ve ignored your college debt for too long, claims can be filed against you. It would then be prudent to seek alternative methods of paying off your debts, such as a personal loan. The interest will tend to be lower and the bill will get paid.

You need to repay your debts – college included – as soon as you can. You should practice debt-free living at every step of your life. Think about simple things like extra clothing, trips, dining out, and movies – all of which can be scaled back, if not eliminated, to help repay your loans. Before purchasing such items, consider whether you really need them. If not, at least defer the expenses to later. Make the elimination of debt your higher priority.