If you’re reading this than chances are you’ve been hit on the head with an unexpected financial crisis and need money for emergency. The first reaction the majority of people have to a financial crisis is panic. Whether you just lost your job, are about to go through foreclosure, car repair – whatever it is – everything is going to be OK. If you are going to deal with this situation the first thing you need to do is get rid of stress, panic, and worry.

Stress and panic effect the brain in a profound way. If you can’t think clearly than you can’t make the rational decisions that will help you get out of this mess.

Something you will want to do is go over your expenses and come up with a budget. Prioritize your expenses and cut the expenses you can live with out. There are certain things that take a higher priority. The necessities you must place the highest priority on are food, housing (assuming you’re not facing foreclosure), transportation, utilities, etc.

Things like cable t.v., the internet, cell phones are all optional. They may seem like a high priority, but if you are either facing bankruptcy or foreclosure its a small price to pay to save yourself. The goal here is to cut every expense you can.

While you’re going over your expenses it would also be wise to go over your possessions and assets. Is there anything you can either sell or downgrade to for emergency money? If you drive a new car, consider selling it and buying a nice little second-hand one. If you own any additional property than sell it! If you can save yourself and get through this financial crisis without selling property or downgrading than by all means do it. BUT IF YOU CANT” – you need to consider it.

Money for Emergency – Contingency Planning

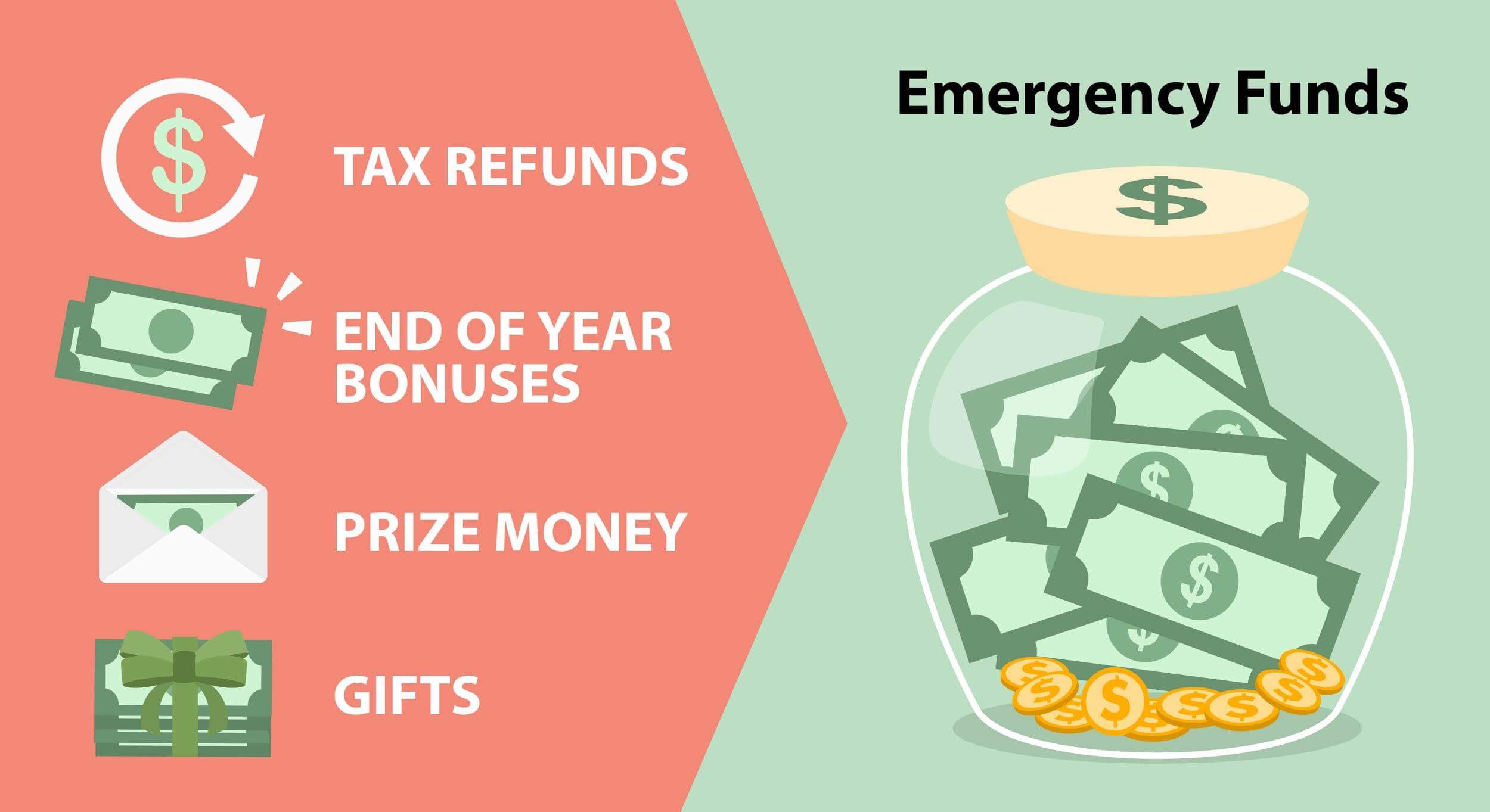

Contingency Planning is one of the most interesting but overlooked part of one’s finances. When most people are asked about the amount they have set aside for emergencies, the answer varies from zero to 2 years of household expenditure, both of which are undesirable extremes.

Contingency planning, though it sounds simple, has a lot of complex issues attached to it.

- Managing Risk: To start with, proper risk management requires us to retain only that risk which we cannot pass on to some insurer. Risk can be in the shape of unforeseen events, some of which can be insured and some not. Death or disability (whether permanent or temporary) of an earning family member is a contingency that can be insured at a nominal cost. Hospitalization of any of the family members is another that can be easily insured from any of the non life insurance providers in the country.

- Possibility of unemployment for short durations: The advent of endless possibilities of employment has also brought uncertainty along with it. The days of job security are over and it is wise to have at least 6 months of critical expenses in liquid form kept aside for a rainy day. This money for emergency can be kept in mutual fund schemes that provide all the desired liquidity and at the same time accrue the growth on a daily basis.

- Money for emergency also has to be kept aside for EMI’s, Insurance premiums and for any medical emergency when a no-cash hospitalization facility is not available and we need cash for treatment, which is reimbursed later by the health insurance company.

- The amount of contingency funds should go up with the number of dependents and go down with the number of working hands. The joint family system is also a built-in safety and acts as a buffer for contingencies. The need for contingency planning is higher in the nuclear family system.

Once you have a clear mind sit down and look at the big picture. What caused this financial disaster in the first place? What options do I have available to me? Do I have family or friends that can loan me money for the emergency? Evaluate the financial situation and go over your options. Try to keep worry at a minimum. By looking down at the big picture you will gain better insight that will enable you to make better choices.

The key here is to find the root of the problem and to attack. You need to create a battle plan. You may want to look into finding a not for profit financial counsellor. I can’t recommend one here, but do your research and find one that is reputable.

So sit down, stop worrying, go over expenses & assets. Cut & sell everything you don’t need – its worth it if it gets you through this financial crisis. Alternatively, you can try to find a loan at a decent rate, or go to a place that specializes in giving money for emergency – but these kinds of things are what got you in trouble in the first place possibly? Only you can answer that.

Comments are closed.