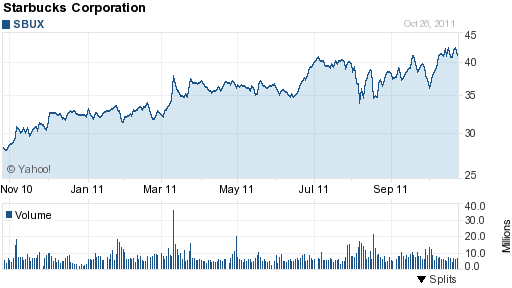

We are looking at a total meltdown of markets as stocks reach record lows. Does this mean that stocks under 5.00 are the safest place for money? In other words, are micro cap and penny stocks really the place where we should be putting our money?

This is not an answer that can get a simply yes or no. First, I do not believe that a deep recession is the right time to invest in in the stock market for beginners. The reason being that if you invest when the market is tumbling down, you are forced to try and game the bottom. And investing in the stock market for beginners is tough enough to have not have to understand all the sectors and individual stocks that may or may not be at their respective lowest.

Again, I do not believe this is the best time to invest in the stock market for beginners. I will give a few things to look for before you begin thinking about investing in the stock market again. Before I do, let’s look at microcap stocks and penny stocks. Basically, let’s look at stocks that are under 5.00

Why would we want to consider stocks that are under 5.00? Simple, the market is at an all time low which implies that many stocks are horribly undervalued because average investors are panicking and dropping out of their shares left and right. This forces the prices to be lower than it should be. This means we have a lot of bargain stocks we can purchase for under 5.00

This is great because if you purchase a stocks under 5.00 then there is a good chance that when the market recovers, you will double, triple, or more, your original investment. A recession is really a good time for bargain hunters in the stock market. When everyone is selling in fear, you should be buying the creme of the crop with a huge grin on your face!

Remember that there is no safest place to invest money, and we have seen just that with the fallout of banking and real estate. Two the most commonly considered safest investment vehicles. So what is the safest place to invest money right now? Probably cash. Since foreign markets are seeing a similar fallout, the dollar is actually holding it’s own, and thus cash seems like the safest place to invest money at the moment.

But, if you’re an investor, then you know that the safest place to invest money is never cash because that means you are losing out on potential returns. So you should always have a discretionary amount of capital that you can invest with out worry. This is the money you should be using to invest in safe stocks for beginners. Stocks that are under 5.00 and really probably to return to significantly higher amounts.

The stock market for beginners can be deceptively frightening. Yes the market is in free fall. But now is the time to start looking at buying. Did I say time to start buying? No. Time to start LOOKING at buying. I personally do not believe we have hit bottom.

So how do we know we have hit the bottom and can then start buying stocks under 5.00? Well, let’s look at the order the dominoes fell.

Real estate hit us first. This would mean investing in REITs for the stock market for beginners crowd. Next we saw the banking sector fallout. Next we could see education, commodities, or something else. Who knows. But the point is, we are still reeling from the terrible loans that killed the stock market.

Why is this important for understanding the safest stocks for beginners to invest money? Well, it would be reasonable to see the dominoes come up in a similar fashion. Namely, the banks fell because no one wants to buy houses, which causes them to default on many loans. So banks are relying on loans to be made to make money. Loans being made means that people are most likely investing in real estate again.

So banks will probably recover after real estate. Just like the order we are falling into the recession. So, for my money, the safest place for money from an investor will be in REITs first. Invest in real estate when you start seeing houses on the market for considerably less time than we do now. When that happens we will know that real estate demand is increasing and stocks for beginners will include REITs that are undervalued. Best if the REIT stocks are under 5.00 and valued at 10.00 or more.

Shortly after we see a huge increase in REITs, look for banks to increase as well. Loans will be made and thus banks will become stronger and regain a footing. This will be the safest time to invest in banks under 5.00

Note that there are not many HUGE banks anymore. This recession has all but wiped out the weakest of banks. Look at the big names, pick which ones you think will get you the biggest return on investment, and buy them. But do not do so until real estate has turned around.

The stock market for beginners should not be as daunting at this point. Turn your money into cash instead of investments, and be patient. When you see real estate turn around, look at buying REITs that have the most probability of going significantly higher. Best if the stocks are under 5.00

Ride the REIT wave a little bit, then start looking for banks to do the same. When you see banks recovering, move your money into them, again preferably is the stocks are under 5.00, and ride that wave.

If we see any other major financial fallouts, look for them to rebound in the same order they fell. Real estate, banks, next, next, etc.

I know that the stock market for beginners can be very intimidating. Just remember that money comes, money goes, and opportunity always exists. You just have to look for it. Start with stocks under 5.00!