Imagine knowing that the next 500 Mondays will be just as dread worthy as the one coming next week. It makes you want to quit your job almost immediately. Unfortunately, you have a mortgage, bills to pay, food to put on the table, and a car on finance. Thus you are resigned to the feeling that you are trapped in your job, and the concept of financial independence or early retirement is nothing but a pipe dream.

Luckily, different stages of financial independence can give you the power to take back your freedom bit by bit so that you can slowly but surely break free from the trap. By identifying your actual financial wants and needs, you can calculate if you have reached stability, can take a lower-stress job with less salary, or can quit the rat race altogether. The way I see it, there are seven stages, and each has specific criteria before you can join the club.

Stage 1: Financially Dependent

Everybody starts at this stage.

It’s when you must have a job to earn money so that you can pay for your expenses in life. That, or there is another person in your life bringing in the money and graciously supporting your cost of living, i.e., your parents.

Without your job or financier, your income will drop to zero, and you will be faced with the challenge of paying your bills and debts or putting food on the table. You know… the basics and necessities of life.

Maybe you can last a short while, like a couple of weeks, before you need to start making difficult decisions – but that dreaded day is coming if you have no income.

This is pretty much the worst stage of financial independence because you have zero independence. Losing your job would be near catastrophic, and if you wanted to leave a job you didn’t like, you’d need to think twice to ensure you have somewhere safe to land.

The sad thing is that too many people are in this stage. If you’re among them, then your only priority should be to start gaining some more financial independence by focusing on three key things:

- Setting up your budget

- Paying down your debt

- Putting some money aside

Stage 2: Financially Stable

At this stage, you’re still entirely dependent on a job, but you’re in a much better position to handle a situation where you might stop earning for a short period.

You would have a sensible budget that works for you and focuses most of your income on essential debt payments, basic living expenses, and savings.

Ideally, you want no debts besides your mortgage or a student loan, depending on the interest rate. Everything else must already be eliminated, such as credit card bills, car finance, and other loans with exceptionally high interest rates.

Depending on your specific situation, you’ll have an emergency fund that covers your cost of living for at least three months, ideally 6, and possibly more. This will give you breathing room if your income suddenly stops.

Finally, you’ll also have some savings for your future years, ideally in tax-sheltered or efficient accounts such as your pension or an ISA (Roth IRA if you’re from the US).

Being financially stable may afford you a decent life – one that’s certainly better than someone else’s who must keep worrying about what will happen if they lose their job next week. But it’s tough to break free from the rat race if you stay at this stage.

Developing your financial independence further will require you to find ways to grow your wealth outside of your average day job. Among these would be:

- Earnings from investment growth and dividends

- Income from side-hustles

- Passive income or royalties from your products

Stage 3: Financially Growing

When you have money that is earning even more or from something you already did in the past, you’ll become a member of this stage. Your job may still be your primary source of income, but it isn’t the source of all your income.

Author’s note: This is assuming you meet the conditions for Stage 2. If you have investment income, but you’re in a lot of credit card debt, then you’re not financially growing… at least not to your maximum potential.

One of the easiest ways to get your money earning more money is by investing it into a low-cost index fund that tracks a globally diversified benchmark and grows around 7% each year on average.

Don’t underestimate this “low” rate of return because it’s money you didn’t need to work to earn and with the power of compounding, your money will grow exponentially over time.

Besides investing, you might have some skills to monetize and earn a little bit of extra money. This will mainly require you to work actively – which has a limit due to time available – but if you’re savvy you might be able to direct those extra earnings into building more passive income streams.

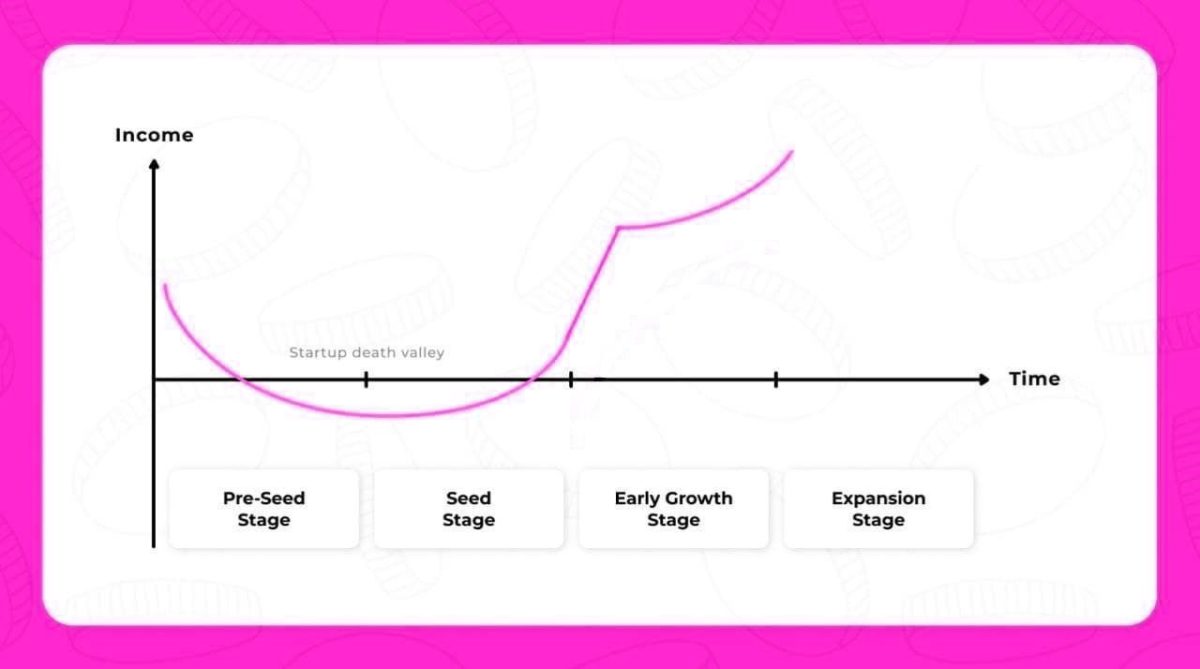

With a bit of focus and discipline, most people can quickly get to this stage, but be prepared to spend a large amount of your time here. At the start, it’s going to be slow, but as you build the momentum, you’ll eventually reach escape velocity, allowing you to leave the rat race.

The accurate indicator is that as each month passes, you will become more financially independent, meaning you are less and less shackled to your job.

The mission is to keep this going until you’ve finally transferred all of your dependence away from your job and can live off your existing wealth and other income sources to the end of your life.

But there’s more!

Stage 4: Coasting to Retirement

As you continue transitioning your dependence away from your job, you will reach a stage where you have enough of a nest egg that effectively means you never need to save again.

There’s just one caveat – the money is only enough to last your traditional retirement and still needs to grow until you reach the age of 67 (or whatever the retirement age for you will be).

Let’s say, for example, you’re 45 years old, and your retirement age is 67, and you’ve calculated that you need £20,000 each year to live while in retirement. Your savings will have 22 years to continue growing and it will hopefully reach an amount that can support your retirement lifestyle.

At a 4% safe withdrawal rate, that would mean you’d need to have £500,000 on your 67th birthday to have money that would, theoretically, last you for the remainder of your life.

Assuming your savings are invested into a low-cost index fund that returns 7% each year on average, you would need roughly £113,000 saved up at 45 to achieve this. Here’s the math:

Savings invested into a low-cost index fund at age 45: £113,000

Years to grow: 22 years

Average annual return: 7%

Savings after 22 years of growth: £500,635

£113,000 x (1.07^22)

This means that once you’ve hit that £113,000 milestone for your savings, you can effectively stop and spend every penny you earn from that moment on without too much concern about your future – since you’ve already set something up for yourself.

Thanks to this, you’ll get your first taste of absolute financial independence because you can choose to keep working your job as usual -keep going – or take a lower paid but lower-stress job to keep you going until you retire.

The choice would entirely be yours!

In my opinion, this is also the stage where you can taste “F**k you money.” While you’re still going to need to work to support your “present-day” living costs – you’re not fully financially independent just yet – you don’t need to be too concerned about your financial future.

A top tip is to build up your emergency fund to an amount that could give you considerable time to live without earning any more money.

Imagine knowing that your retirement years were secure and having the money in an emergency fund to support your living costs for the next 12 months. The moment you get sick of your job, you could say “F**k it,” and move on.

Stage 5: Financial Independence

At this stage, you can finally decide to stop working and live off your current wealth and investments for the rest of your life, regardless of your age, albeit that lifestyle might be pretty basic.

At this stage, you can finally decide to stop working and live off your current wealth and investments for the rest of your life, regardless of your age, albeit that lifestyle might be pretty basic.

You would have needed to continue to “Financially Grow” to get here beyond the “Coasting to Retirement” stage. The more of your monthly income you can save and invest, the sooner you’ll get here (obviously).

Let’s say you average £1,500 monthly on general living costs covering housing, bills, groceries, new clothing (infrequently), and other basic activities. At a 3.5% safe withdrawal rate, that would mean you’d need to have roughly £515,000 in your current investments to support that cost of living. Here’s the math:

The annual cost of living: £18,000

(£1,500 x 12 months)

Investments balance: £515,000

Withdraw 3.5%: £18,025

(£515,000 ÷ 100) x 0.35

New Investments balance: £496,975

Grows by 7% on average each year: £531,763.25

£496,975 x 1.07

You might have noticed that in this example, I am using a 3.5% SWR instead of 4%, like in the earlier example. This is because I assume you need your money to last longer, potentially much longer.

While the safe withdrawal theory says your money will keep lasting your lifetime or even increase over time (as seen in the above example), you never know what will happen in the future regarding returns on investment. Therefore the lower rate accounts for this, and you can always increase it if things are playing out quite well.

Author’s note: I’ve assumed that all of your money comes from investments you’re drawing down from. However, other passive sources of income, such as rental income or income from royalties, would also count and could lower the amount you need to have invested.

Now you have “F**k you money” because you no longer need to work if you don’t want to.

Bored of your job or what you’re doing – just quit!

Don’t like your colleagues, your boss, or your customers? – stick it to them!

Got fired – who cares?

You’re financially independent by this point, and any other income you earn on top of what you already have or would’ve been earning – for example, continued growth in your investments – would be “excess” and not “required.” However, it would improve your quantity of life.

This is an important difference between this stage and the next – at this stage, you’re fully independent, but your income can only support the basics of life.

You can enjoy simple hobbies like road trips, hikes, outdoor activities, family days, homecooked foods, and the occasional activity. But you’d need to think twice or plan a little to partake in some things that could be slightly more costly. If that’s what you’re looking for, you’ll want to keep going until at least the next stage.

Stage 6: Financial Freedom

This is the stage that most people are probably wishing to get to whenever they’re thinking or talking about financial independence. It’s where you can afford the relatively average lifestyle you want, including some luxuries you feel are worth paying for.

You could easily spend money on at this stage: Regular holidays abroad, a decent car, weekly meals out in more excellent restaurants, new clothes more regularly (but not the designer stuff), paid clubs and hobbies for your children.

While the actual amount of money spent each year will vary from person to person – or family to family – a benchmark number for this stage of financial independence seems to be $40,000, probably based on a 4% safe withdrawal rate on a million.

But let’s say £40,000 since this comes from a UK-based writer.

At a £40,000 income, you would have £3,333.33 to spend each month, which is more than sufficient to support a family of 4 people in most areas of the UK, especially if you’re mortgage free.

You’ll be comfortable if you’re living a normal life. You mostly cook meals at home, have a gym membership, go on family holidays once a year, and buy new clothes every couple of months. You know, the same things that you would’ve done when you weren’t financially independent

The only real difference is that you’re not trapped in a day job, and you can do whatever you want with those hours you have back in your life.

As I said before, when most people think about financial independence, they’re talking about this stage. But there is one more stage for those who want to live in more luxury.

Stage 7: Financial Abundance

This stage is when you have much more money than you need and can live a life of luxury. In other blogs, forums, or financial independence communities, you might hear this being referred to as “Fat FIRE.”

Holidays abroad happen multiple times a year; you have a nice car (better than a decent one), you mostly eat out at restaurants, you have a pretty big house, you can buy designer clothes and accessories, and you can send your children to private school.

How luxurious a life you lead will, of course, depend on your income level, but the benchmark appears to be at least £100,000 a year in spending money. At a 4% withdrawal rate, you need an invested net worth of £2.5 million.

Getting to this would require quite some effort and possibly not worth it for people focusing on early retirement.

Let’s say you have achieved stage 6, Financial Freedom, and have a net worth of £1 million. If you were to keep saving and investing £1,000 each month from that point, it would take you another 13 years to surpass £2.5 million, assuming a 7% average annual return.

If you were to save and invest £3,000 a month, it would take 11 years.

At £5,000 a month, it takes nine years.

Don’t forget you’re starting from £1 million, not £0.

A little bit of luxury in life isn’t bad, but if you need to keep working another decade before you can “afford it” then you might want to think about the true value of those things – don’t lose sight of your original goal!

Final Scribbles

When I first started on my journey towards financial independence, I found it daunting due to the massive number I would need to reach.

Even by investing my savings, I was looking at quite several years before retirement was a real prospect for me. Even though I would be retiring early, in my mind, it wasn’t early enough, and I found it highly demotivating.

But, by breaking the goal of financial independence into stages and realizing that I wanted the last but one stage of “financial freedom,” the mission became much more digestible.

Whenever I feel hopeless about the whole mission, I remind myself of these stages, and when I see where I’ve managed to get myself since starting in 2015, I remember that everything is going very well.

Once I remember that small fact, I become much more focused, motivated, and, more importantly, patient.

Hopefully, it can do the same for you, too – keep going!

You can change your mindset to be impressed with your savings progress rather than trying to keep up with other people’s spending behaviors. Just because someone has a fancy car or purse doesn’t mean you need to buy one. Impress yourself with your money-saving abilities.

You can change your mindset to be impressed with your savings progress rather than trying to keep up with other people’s spending behaviors. Just because someone has a fancy car or purse doesn’t mean you need to buy one. Impress yourself with your money-saving abilities.

At this stage, you can finally decide to stop working and live off your current wealth and investments for the rest of your life, regardless of your age, albeit that lifestyle might be pretty basic.

At this stage, you can finally decide to stop working and live off your current wealth and investments for the rest of your life, regardless of your age, albeit that lifestyle might be pretty basic.